In a number of cases established by law, it is implied that the online cash register is removed from the tax register. As you know, modern equipment transmits all necessary information according to a simplified scheme, it sends data to the servers of competent control services. It is a simpler and more reliable system that replaces the outdated one. Of course, new levels of reporting are emerging, global monitoring from the side government agencies, and as a result, you won't be able to get rid of the device just like that.

How to deregister a cash register in a tax office: key features

Previously, the procedure was much more complicated. At least because without the involvement of technical specialists from the service center, it was impossible to correctly read the data in order to provide it to the Federal Tax Service. Accordingly, third parties entered the game, on whom the timing depended. And the freezing of the trading floor at the time of the operation is quite common when working with outdated equipment.

In addition, a massive package of various documentation was needed. It had to be collected and transported or personally taken to the competent authorities. The task is not so much difficult as intricate and lengthy. The new procedure is simplified, but has a number of its own peculiarities. The algorithm of the following actions largely depends on the reasons for the closure and termination of functions.

Foundations

So, let's look at what situations can be a consequence for making such a decision. It should be understood that entrepreneurial activity- this is a purely voluntary matter, and its termination is possible at any time. So, in fact, explaining something to the Federal Tax Service Inspectorate when the cash registers are closed is a whim. But if this is not done, then additional questions may arise. Therefore, in most options, it is logical to choose the lesser of evils.

How to remove an online cash register from the tax register yourself, voluntary closure

The manager is free to simply get rid of the current equipment at the enterprise and acquire new ones. But in most cases, no one will throw away properly working devices. This is just an unprofitable move. It is another matter when the requirements of the new norms of the law were forced to completely change the cash discipline.

Of course, upon termination of activities and liquidation legal entity also everything will have to be closed. Common cases of a business entity:

Breaking. This implies a level of malfunction when further operation is virtually impossible. For example, if the equipment has external damage that, in principle, does not interfere with its normal operation, but spoil its visual appeal, this does not apply to this case. Of course, the device will be changed, no one wants to spoil the reputation by showing the client at the point of sale external damage. It looks impartial. But there will be no actual breakdown. And if the machine simply cannot perform its functions, then this is our case.

Sale or transfer. Even if the owner has not changed, the closing procedure is still implied. Deregistration of a cash register at the tax office is necessary if the device was transferred to another branch, city, even another point of sale, and the like is mandatory if after the transfer the owner has changed, that is, the fact of donation has occurred.

Theft. The rarest case. Taking into account modern security measures, constant video surveillance at points of distribution of products, security, it is difficult to crank up such a maneuver. However, rarely does not mean never. And in this case, the fact of theft will still need to be proven. Without evidence, a check will clearly be launched to reveal intent to conceal or evade taxes. This is the order in which the inspection works.

Deregistration of the cash register in the tax office forcibly

Let's move on to the moments when the service itself, without the consent of the owner of the hardware, blocks the reporting of the device. There are also few such options.

Upon liquidation of a legal entity. Moreover, regardless of whether it was a voluntary termination of activities or, for example, bankruptcy. As we clarified, you can submit an application yourself. But on general rules The FTS organizes the procedure on its own. The start will coincide with the date of deletion of the record from the corresponding database. Unified State Register of Legal Entities or EGRIP, depending on whether the company worked on the basis of individual entrepreneurship or as an LLC.

For violations. If the operational and functional properties do not meet the requirements of the current legislation. This usually implies the fact of using outdated technology. After all, all the new products on the market are produced taking into account the current rules and regulations.

When you go beyond the operating life of the drive. Moreover, even if the machine works completely properly, there are no failures and malfunctions. The time allotted by the manufacturer has ended, you must immediately notify the service. However, she herself will react even without a statement.

The timing

A very strict limit is set. Exactly one day is given for everything. That is, we are talking about a voluntary basis. If there is a breakdown, theft, loss, sale, and so on. It is noteworthy that during this time it is also necessary to collect the evidence base, if we are talking about theft. And only then forward the data. Do not have time to meet in one day - get ready for fines. Therefore, it is important to act promptly, and also quickly receive and process information. And for this it is necessary that the entire structure functions on modern software and is managed by a competent person who personally accepts responsibility.

For the best and most adaptable software it is recommended to contact the Cleverens company. She specializes in programs designed for Russian market, taking into account local legislation and the whole mass of its nuances, which have appeared quite recently, or are just planning to be introduced.

As for the question of how to remove the cash register from the tax office - if violations have occurred or the service life has expired, then the time does not matter here. After all, this is already the competence of the Federal Tax Service. So they decide for themselves how quickly to react. But to the credit of the organs, it must be admitted that they usually also fit in just one day.

The order of the procedure

Now let's go directly to the specifics. Let's see how to close correctly when you can work remotely through your personal account on the site. You will also need a registration key for it. You need to register on the FTS resource in advance. Naturally, most of the entrepreneurs did this a long time ago to simplify reporting. But there are those who still do not want to keep up with progress. Immediately, we note that this is the wrong choice, which can be accompanied by serious financial costs.

So, with a voluntary procedure, we need to somehow notify the authority that this or that incident has occurred. That we want to initiate the deregistration of the cash register at the tax office, and we have good reasons for this.

The instructions for drawing up depend on the form. While we will analyze the paper, the transfer is meant in person when visiting the department. Although, in most cases it is more logical and more convenient to send a request remotely.

Remember about the deadline for submitting an application so as not to provoke the service to penalties. It is necessary to use a form of the established sample, which can be easily found on the net. For example, on the website of the same tax authorities.

The following points must be indicated in the application:

Taxpayer details. The TIN of a legal entity is implied. Needed as individual entrepreneur, and LLC.

Information about the organization. Indicate the name, legal and physical address.

The reason why technology should in principle be eliminated from monitoring. In most cases, if this is a voluntary decision, then this is not the most important point that can even be omitted. But if theft is meant, then it is strictly necessary to voice this moment.

Information by whom the application is submitted. This can be either a directly authorized third party, that is, a representative, or a director, founder, owner of the company.

Also, something else should be added to the question of how to close the online cash register at the tax office. Namely, what needs to be added to the statement.

Additional documents

The first of them is the report - the removal of the latest data from the registrar, which are necessary to complete the procedure. If the equipment itself functions, then there will be no problems with this. The situation is much more complicated if it is damaged. Moreover, the nature of the breakdown also matters. In case of any malfunctions related to the cash register equipment, which did not affect the fiscal recorder itself, it can be simply removed. But if it has become unusable, and the data cannot be obtained from it, the nature of the task changes.

You will need to send a request directly to the manufacturer. Explain the situation, point out the need for reporting. In this case, he cannot refuse according to the law. A technician will arrive and either take the equipment with him or solve the problem on site. This option provides additional time for retrieving information. This is up to 60 calendar days from the date of the application.

But if the fact of theft has occurred, then no results will be provided, and the Federal Tax Service, according to the law, cannot even demand them. But at the same time it is able to initiate a check, which is designed to identify the presence or absence of theft. Employees will be guided by evidence of appeals to the authorities. Therefore, as soon as the person in charge suspects a crime, the theft of an object, you must immediately submit an application to law enforcement agencies. There, get a coupon stating that the application has been accepted, and, along with a copy of the application itself, save it, and then present it during verification. You can also act preventively. That is, when the fiscal accumulator is deregistered, attach all the papers received from the police to the documents for dispatch.

We work through a personal account

Let's move on to the deleted form. It is more comfortable, modern and reliable. And in the lion's share of cases, it is logical to use it. Moreover, if we take into account the short terms that the law sets aside for the implementation of this action, namely, a day, in the usual form, you simply may not be in time.

To work, we need an account on the FTS website. It is necessary to create a profile in advance, this is not required by law now, but in principle, without your account, many procedures will be complicated at times.

You will need the CCP section, which can be found in the upper vertical menu. It is indicated by symbols technical device, it is difficult to confuse.

In the menu that opens, go to de-registration by clicking on the corresponding plate.

Now we need to fill out a short questionnaire. In fact, you will have to indicate all that information, as in the application in the usual form. Just virtual. We fill it out meticulously, an error can be a reason for refusal.

We use our electronic signature.

Next, your request is sent to development. It is closely examined by employees and will soon report on the progress of the audit and the decision. They should often check their personal profile on the site to keep abreast of the situation.

How to understand that the procedure is complete

Having figured out how to deregister online cash register in the tax office, you also need to find out in time that the process was successful. Indeed, in the event of a refusal, if we missed something, made a mistake, then time becomes a very important indicator. After all, we remember about the short terms that are allotted to us by the service. Many managers, after sending, simply close the page and do not appear there until the next need. Without even suspecting that at the moment they may already be breaking the law. And serious fines are looming more and more on the horizon. And well, if only they, and not accusations of criminal intent.

And the verification procedure itself is simple to the point. It is enough to go to the same menu and see the fate of the application. If everything went well, we will see a confirmation with a green checkmark. Or a refusal with a red cross. In principle, you can also focus on the card that the service will send within five days. Again, if there was approval.

What to do after completing the process

It all depends on how you put the question. In fact, you don't need to do anything. If we talk about the termination of the operation of this equipment. But to get it back into operation, you will have to try. There was a breakdown - we turn to technicians, we get their conclusion. And if restoration is possible, we fix it. The fiscal registrar is out of order or its operational life has expired - all that remains is to acquire a new unit. And then continue to work.

In case of theft, we contact the police. Of course, the chance that the loss will be returned to the owner is not the greatest, especially in good condition, but it is there.

It is important to understand that as soon as the device becomes functional again, it will have to be registered again. You can't just include it in the work. The same is true if a sale has occurred. The new owner is obliged to register. By the way, let him know just in case. It might even be a good idea to do a little consultation.

In fact, as we figured out, it is not so difficult to remove a cash register from the tax office on your own. Especially if you use the remote method. It takes half an hour at most. Including collection of documents. Of course, when we do not need to receive papers from third parties. Therefore, it is easy to manage in one day. Another thing is that many simply do not understand the tight deadlines, postpone the solution of the problem until later, receiving fair comments and penalties in return.

Views count: 6,547

Who and why removes online cash registers from registration

Online cash register is a new type of cash register that replaced cash registers with EKLZ from July 1, 2017 (and mandatory for use by the absolute majority of companies and individual entrepreneurs from July 1, 2018) - should be timely:

- Registered.

Only if the device is registered with the Federal Tax Service (in the general case this procedure is made through a personal account on the website of the tax service), an economic entity can legally apply online cash register.

The law does not define any terms for registering a CCP. The main thing is not to start trading without completing this procedure.

- Deregistered.

Deregistration of a cash register is carried out by the tax service at the request of the device user (clause 5 of article 4.2 of the law "On CCP" dated May 22, 2003 No. 54-FZ). It must be filed with the Federal Tax Service the next day after:

- transfer of the device to a third-party business entity;

- revealing the fact of loss or theft of the device.

In turn, the Federal Tax Service itself (without participation commercial enterprise) removes the cash register from the register if:

- revealed non-compliance of the CCP with the requirements established by law;

- the term of use of the fiscal drive has expired - a removable hardware component of the online cash register, which is responsible for the formation of payment data, encrypted and transmitted via the Internet to the Federal Tax Service.

If an economic entity is liquidated, then the FTS in this case also removes its CCP from the register on its own (clause 85 of the Administrative Regulations by order of the Ministry of Finance of Russia dated June 29, 2012 No. 94n).

The procedure for deregistration of a cash register by a taxpayer

Let us now consider the general procedure for removing an online cash register from the register, if it is initiated by the owner of the cash register himself.

To cancel the registration of a CCP on record on its own initiative, the taxpayer needs:

- Send to the Federal Tax Service a statement in the form, which is reflected in Appendix No. 2 to the order of the Federal Tax Service of Russia dated May 29, 2017 No. ММВ-7-20 / [email protected], on time.

An application for deregistering an online cash register can be sent to tax authorities:

- in paper form;

- electronically - through a personal account on the FTS website.

Along with the application, it is necessary to submit to the Federal Tax Service (include in the application using online tools) a report on the completion of the drive - if the cancellation of the registration of the cash register is not due to loss or theft (clause 8 of article 4.2 of Law 54-FZ). If the device was used in the mode without sending data to the Federal Tax Service, then in order to cancel its registration, the records copied from the fiscal drive must be transferred to the Federal Tax Service (clause 14 of article 4.2 of Law 54-FZ).

- Obtain a card from the Federal Tax Service, certifying the fact of removal of the CCP from registration.

This document within 5 days after the FTS accepts an application from the owner of the CCP becomes available in the Personal Account. You can request a paper copy from the Federal Tax Service.

If the card is not received within the specified period, you should contact the territorial office of the Federal Tax Service for clarifications.

It will be useful to familiarize yourself with the structure of the application form, which is used in order to remove the online cash register from the tax register.

Don't know your rights?

What does a statement about the removal of a cash register from the register look like?

The application shall consistently indicate:

- The name of the business entity - in accordance with the charter, registration documents issued when registering with the Federal Tax Service.

- Taxpayer TIN.

- Model name KKT.

- Serial number of the device.

- A mark stating that the reason for replacing the device is theft.

- A note stating that the reason for replacing the CCP is loss.

If you do not tick off items 5 and 6, this means that the device will be excluded from the FTS registers due to its transfer to another person.

- Number of application sheets.

The application is certified by the head of the legal entity or individual entrepreneur (by his representative by power of attorney - indicating the details of the document).

A report completing the statement on closing the drive is created on the computer to which the cash register is connected (or on the device itself, if it is an autonomous type of cash register), using software from the manufacturer of the cash register.

The data recorded on the fiscal accumulator is collected and transmitted to the Federal Tax Service in the manner reflected in the letter of the Federal Tax Service of Russia dated February 16, 2018 No. AS-4-20 / [email protected] In particular, it is supposed to place such data on a special USB-medium, which is adapted to secure receipt of fiscal data from the drive.

So, now we know what actions a taxpayer has the right to take in terms of interaction with the Federal Tax Service with an online cash register - how to deregister it and what documents and data to prepare.

Consider, in turn, the actions of the taxpayer in response to the cancellation of the registration of the cash register on the initiative of the Federal Tax Service.

The cash register was removed from the register on the initiative of the Federal Tax Service: what to do next

So, an online CCP can be excluded from the FTS registers without the participation of the taxpayer if:

- Revealed the non-compliance of the CCP with the requirements of the law.

- The service life of the fiscal accumulator has expired.

In both cases, if the user wishes to continue trading, the device will need to be re-registered with the Federal Tax Service using an application for re-registration. Its form is approved in Appendix No. 1 to the order ММВ-7-20 / [email protected]

In the first case, re-registration is possible subject to the elimination of violations. Such violations can be:

- use of a cash register that is not included in the register maintained by the Federal Tax Service;

- the use of a CCP that does not fully possess technical characteristics established by Art. 4 of Law 54-FZ.

In the second case, re-registration is possible provided that the fiscal accumulator is replaced with a new one.

IMPORTANT! In this scenario, within 1 month, the taxpayer needs to transfer to the FTS all the data reflected in the fiscal accumulator (clause 16 of article 4.2 of Law 54-FZ).

In this case, the statement must be supplemented:

- drive closing report;

- a report on the adjustment of the registration parameters of the cash register in connection with the installation of a new fiscal accumulator (like the first document, it is formed on the cash register).

IMPORTANT! The same must be done if re-registration when replacing the drive is carried out without removing the CRE from the register (this is possible if the replacement was carried out within the life of the drive or due to a change in the taxation regime for which the current drive is not suitable).

Removal of the CRE from registration can be made at the initiative of the user - when the CRE is transferred to another person, the online cash register is lost or stolen; or the FTS independently - upon detection technological violations in the work of the cash register and at the expiration of the storage life established by the technical regulations. In the first case, you need to submit a statement to the Federal Tax Service and supplement it with the data specified in Art. 4.2 of Law 54-FZ. In the second, if the cashier needs to be used further, it will be necessary to re-register the device in the manner prescribed by law.

Cash register is a mandatory attribute that should be used by almost all business entities. For the application of the CCP, the tax authorities approved special rules. In this article, we will figure out how to properly remove the cash register from the tax office.

Apply without fail

Before defining an algorithm on how to deregister cash registers in the tax office, we will tell you who is obliged to use cash registers in their activities.

Fill in the document by hand or compile it in electronic format through the taxpayer's personal account.

The finished package of documents can be handed over personally or through an authorized representative. But for this you have to issue notarized power of attorney... Also, the documentation can be sent to the IFTS through the Russian Post. But for this option use ordered letter, do not forget to fill out an inventory of attachments.

The third way to submit an application and documents for the removal of a cash register from registration with the Federal Tax Service is via the Internet. To do this, you need an account on the "Gosuslugi" portal or registration in personal account taxpayer.

Deregistration of a new cash registers, which has the function of transferring data to the Federal Tax Service online, occurs by submitting an application through your personal account on the website of the Federal Tax Service or the OFD, as well as by contacting the tax authority. You do not need to submit any documents, except for a statement and a report on the closure of the fiscal accumulator, to the IFTS.

Removal from the register online checkout happens easier than before when application of KKM without the function of transferring data to the Federal Tax Service.

If earlier it was necessary to collect a package of documents, attract the TEC and receive certain documents from them, now the process of closing the cash register is limited to filing an application with the tax authority with the attachment of a report on closing the fiscal accumulator (hereinafter - FN).

Voluntary closure of a cash register from registration

On the initiative of an individual entrepreneur or organization, an online cash register can be deregistered in the following cases:

- when transferring the cash register to another user;

- in case of theft or loss of cash register;

- in the event of a malfunction of the device, which does not allow further operation.

Forced deregistration of cash register

The tax authority may unilaterally deregister the CCP in the following cases.

- The fiscal accumulator has expired.

If the tax office closed the cash desk due to the expiration of the fiscal attribute key in the FN, the user of the cash desk is obliged to provide the IFTS with all fiscal data stored on the FN until the cash desk was closed within a month from the date of the cash desk closing.

- The cash register does not comply with the requirements of the current legislation.

Re given cashier can be registered only after elimination of violations identified by the tax authority.

Closing date for cash register

The voluntary closure of the online cash register takes place no later than one working day from the moment:

- transfer of the cash register to another user;

- loss or theft;

- failure.

Closing order

- Drawing up an application for deregistration of a cash register

What should be contained in the application for deregistration

The application must indicate:

- full name of the organization or full name of the individual entrepreneur;

- TIN IP or LLC;

- unit model and serial number;

- the reason for removing the cash register from the register (in case of theft or loss);

- data on the number of sheets of the application (001 - sheet, if the application is submitted by the head of the organization or individual entrepreneur in person, 002 - if by his representative);

- data on the person submitting the application (full name).

Note: if the application for closing the cash register is submitted by a representative, then it is necessary to fill out the second sheet of the document, where you need to indicate the name of the document certifying the authority of the representative.

On deregistration of an online cash register.

Figure No. 2. Application form for deregistering the cash register. Source: site consultant.ru

To close the cash register.

Figure No. 3. A sample of filling out an application for deregistration of a cash register.

Deregistration of a cash register is necessary if the cash register is no longer needed, transferred to another legal entity or individual entrepreneur, stolen or lost.

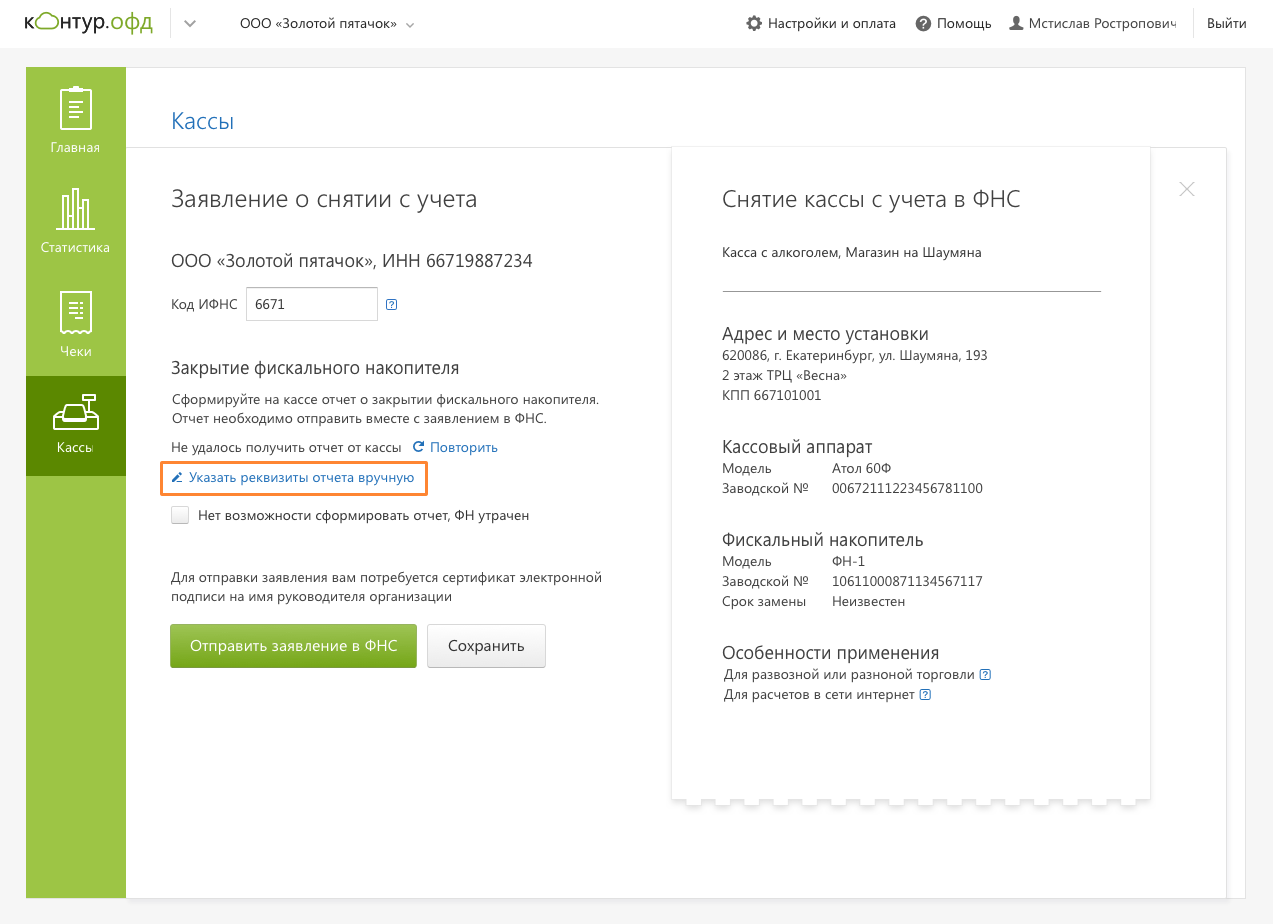

There are three ways to apply for deregistration: in person at the tax office, on the FTS portal or in the personal account (LC) of the fiscal data operator. Kontur.OFD users can remove the cash register from the tax office on their own in the LC.

Before removing the cash register from the register, generate a report on the closure of the fiscal accumulator (FN) at the cash register. If the FN has broken down and the report has not been generated, you can remove the cash desk from registration only through the Federal Tax Service. The FN can be closed using the utility for registering the cash register on the computer.

If the cash register is stolen or lost, file a report with the police and receive a certificate of registration of the application. This certificate is needed when re-registering a cash desk through a department of the Federal Tax Service.

If you are applying online, no proof certificates are needed.

Deregistration of an online cash register through the Federal Tax Service

- In the "Cashier" section in the LC Kontur.OFD go to the cash register card and click the button "Deregister with the Federal Tax Service".

- Enter the IFTS code. The data of the report on the closure of the fiscal accumulator will appear in the application automatically if the cash register has a connection with the OFD and access to the Internet.

- If the cash desk has no connection with the OFD and the report on the closing of the FN did not appear in the application, you can specify its parameters manually.

The date, time and other parameters must be taken from the printed report on the closure of the FN.

- If it is not possible to generate a report on the closure of the FN due to the loss or theft of the cash register, indicate this.

- Sign the application electronic signature the head of the company and send.

The authority has 10 working days to respond from the submission of the application to Kontur.OFD.

When the Federal Tax Service approves the application, a withdrawal card will be sent to the LC. The card has been generated - the cash desk has been removed from the register.