The Auctus project, built on the Ethereum blockchain, was founded with the goal of improving the retirement market by increasing transparency and addressing issues such as corporate governance, corruption, fraud, bribery and bureaucracy, and lower operating costs.

Essentially, the Auctus smart contract and system based can replace the entire structure of pension fund management.

PRODUCT

According to the company's website, the project was founded in Brazil in Belo Horizonte, where some of the management and developers are located, but the administration of Auctus is located in Zurich, Switzerland. There was no other data on where the company was registered.

The project is under active development. On Github, you can find and familiarize yourself with the smart contract code, a demo version of the platform for managing pension funds, and much more.

If we talk about competition in the market pension funds, then we can mention the project called, but it did not advance further than the idea. Taking into account the more and more frequent news in the media that a particular bank wants to test blockchain technology in relation to pension funds, it is safe to say about fierce competition in the future, but so far the Auctus project is seen at the forefront (,).

The project is presented in a discreet manner without spam and water, which gives it a seriousness, and it fits well with the area in which Auctus is going to work. The official pages are presented on the following resources: (3262 readers), (42 readers), (704 readers), (1906 participants), (1262 subscribers),. Some of the articles about the project on third-party resources:,. There are also articles on,

In addition, judging by the successful one, which was closed in 10 hours 56 minutes, having collected 958.9 ETH, which is about $ 300,000, and because the topic of pension savings is relevant for many of us, the community's interest in this project as investors is quite high and potential users of the platform.

USING THE BLOCKCHAIN

Thanks to the blockchain, the platform offers the following advantages over existing systems:

- Better corporate governance. Governance is improved thanks to the transparency of smart contracts.

- Automated collection of contributions and pension payments. Paying deposits or withdrawing funds becomes much easier because all mechanisms are defined in smart contracts and can be automated.

- Cost transparency. All fees will be automatically deducted from transactions. The cost of these fees is determined publicly in smart contracts, and each fee is permanently recorded on the blockchain.

- Fraud protection. Terms of payment fraud and theft of funds can be eliminated after all transactions are recorded on the blockchain.

- Control of insurance premiums. Using smart contracts registered in the blockchain, everyone can know exactly the nuances of insurance payments.

- Cost effective data management. The technology can significantly reduce the costs of servers, storage, and maintenance personnel.

The WhitePaper states that “regardless of the monetization scenario, all commissions will only be paid to Auctus Tokens (AUC), making it an integral part of the platform. There are no details in response to the question“ How exactly will this work? ”However, comments were received. from one of the team members () - "we have a project with a detailed description of the token in the ecosystem and in the coming days, after consultation with advisors, we will release our model for using the token. It will be necessary to access services, tools and other functions."

The Auctus project plans to become a global blockchain platform for pension funds, designed to adapt to various legal and regulatory standards. From point of view functionality smart contracts, there are no contradictions here and it sounds quite feasible, although there may and most likely will be difficulties with the legislation.

Legal requirements and restrictions for pension funds vary from country to country. Therefore, initially Auctus plans to work on the development of smart contracts for existing funds... Thus, each foundation will be responsible for checking legal requirements.

WHITE PAPER

White Paper is presented on 30 pages. Reading the document does not make it difficult to understand the material presented. The document describes general principles work of the platform, problems and solutions of the pension fund market.

There is a significant gap in the logical and coherent description of the idea about the participation of the token in the ecosystem. Plus the absence of any clarifications on legal issues.

ROAD MAP

A clear sequential plan of action with simple and understandable logic.

The development plan and some other factors (gradual unfreezing of tokens after, etc.) indicate that the company is not striving to obtain short-term benefits, but is trying to create a project for many decades to come.

TEAM

The project is led by Felipe has over 12 years of experience in development software... He has over seven years of experience as Operations Manager and Partner at DTI Digital.

The team consists of 11 people and consists mostly of experienced software developers with a rich track record. Strange is the fact that, according to information from WhitePaper, the chief programmer responsible for blockchain-related developments cannot in any way confirm professional skills and, in general, at least some of his attitude to the project.

Advisory support is provided by specialists in the field of finance, pension law and analysts.

ICO DETAILS

Pre-ICO began on October 3, 2017 and was closed in 10 hours 56 minutes, having collected 958.9 ETH, which is about $ 300,000. The price of the token was 2500 AUC for 1 ETH.

The main phase of the ICO will begin on November 14, 2017 and will last until November 28, 2017. If the maximum goal of fundraising, which is 90,000 ETH (about $ 27,000,000), is reached earlier, then the ICO will close ahead of schedule. The token price will be 2000 AUC for 1 ETH. The minimum fundraising goal is 15,000 ETH.

The smart contract address will be shown a few days before the ICO.

Distribution of tokens

- Core Auctus Team (20%)

- ICO participants (51%)

- Reserve for future stakeholders (18%)

- Partnerships and consultations (9%)

- Bounty Program (2%)

Despite the fact that the project team receives 20% of the total number of tokens, and their number was not specified for some reason, the project decided to act in a very attractive way for investors - all collected funds will be blocked during the ICO period. At the end of the ICO period, the contract will allow you to withdraw 20% in the first month and 5% each in the next 16 months.

FINAL ASSESSMENT AND CONCLUSIONScore 4 points out of 5 possible. The project is clearly capable of revolutionizing the pension savings industry. The disadvantage of the project, which does not make it possible to fully assess the possibilities, is insufficient information about the participation of the token in the ecosystem (according to one of the team members |

I thought for a long time where to start publishing in 2018: and I realized that the answer lies on the surface - from conclusions about what I did the most in 2017, that is, from the analysis of ICOs and forecasts for this industry. But I will say right away that the study turned out to be voluminous, so it was decided to split it into at least three parts.

The first will provide general analytics of the ICO together with the Icofisher.com team - the project is in beta version, but it is already doing a good job with the task (technical analysis of blockchain projects). In the second I will try to focus on one of the most terrible for the industry (in Russia) project - ZrCoin, and in the third - already on the world MMM-format scam - ... However, first things first.

There was already an article on Forbes by Anti Danilevsky from Kickico, where he examines the portrait of a participant in the IPO campaigns, but I will try to identify other trends and in a larger sample.

2017 was remembered by the crypto community for its ICO boom: nevertheless, it is extremely difficult to find intelligible information on this phenomenon, and many still cannot understand what it was. To begin with, I tried to answer the question: "who invested and how much in 2017?" Data from 40 ICOs was taken as a basis: among them - EOS, Status, Bancor, Lexec, MatchPool, Tenx, IndaHash, Raiden ...

How much is the total?

So what kind of sample do we have? 500K transactions. People invested from 0 (hereinafter, accounting - only in whole units) to 150,000 ETH. 95% of all payments fall in the range from 0 to 20 ETH.

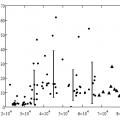

Let's try to divide all investors into groups depending on the amount invested. Applying the k-means method on the entire sample as well as on individual ranges, we identified the following groups (Fig. 1):

The ICO assessment for the selection of those projects that are capable of developing and bringing the investor a profit includes several stages, at each of which it is necessary to study one of the parties to the project. Only such a multidimensional approach will provide an accurate analysis and help to select promising ICOs.

Let's consider in detail the stages of the analysis.

The project team

Any development, both successful and unsuccessful, is created by people. The team of specialists that will work on a project largely determines its success or failure.

- The publicity of the team members. The presence of their contacts in social networks, participation in conferences, forums, professional communities, meetups (informal meetings), etc. Look for team members on BitcoinTalk and other cryptocurrency forums. Real professionals are always active online, communicate with colleagues and exchange experiences. If team members are not public and closed for communication, this should be alarming.

- Portfolio of team members(project names, when created, results achieved). If the team's specialists have positive experience in the field of their development or a field close to it, this is a plus for the project.

- Company verification. But it is not always easy to carry out it and, in general, it is possible because most of the projects are registered in offshore zones.

- Offshore(English offshore - "off-shore") - a country or territory in which special conditions apply commercial activities for foreign firms. Typically, these are low or zero taxes, simplified reporting, and the ability to maintain anonymity for business owners.

- Team members openness, their willingness to communicate. Write to the developers, ask your questions. So you will be able to assess their efficiency, politeness and clarity of answers, the style of communication with investors and check the efficiency of these contacts for communication.

Sometimes it can take a few days to test the startup team on all of the above points. But it's worth it: the success of the implementation of any project depends, first of all, on the specialists who work on it. A bad team will ruin even the most promising idea.

The technical side of the project

At this stage of the analysis, it is necessary to assess the viability of the idea underlying the project, the plan for its implementation, specifications and offers for investors.

What you need to pay attention to:

- The quality of the idea. It is preferable to choose projects whose creators, by the time they enter the ICO, can already present to the public any model or prototype of their development. On the basis of this, it is possible to assess the potential of the idea and the feasibility of its further development. If the authors of the project are scattered in beautiful promises, have a vivid presentation and nothing more, then it is better to bypass such projects. The risk of investing in startups is already very high, but in the absence of concrete evidence that developers are really capable of something, it increases many times over.

- Project development plan(the so-called "roadmap" - roadmap). The founders of a startup must prescribe its prospects, development strategy, specific goals, indicating the timing of their achievement and the steps that will be taken for this.

- Project source code. If you are going to invest quite a large amount of money into development, then it would be useful to check its source code. You can attract a special person for this. Usually all projects place their codes in open access on Github'e.

- White paper(translated from English - "White Book"). Contains a description of the project, investment proposal and other information.

Additional points of analysis

The assessment of the project team and its technical side is not enough.

It is also necessary to analyze the following components of the project:

- Competitors, including from the Internet environment. For example, today there is a p2p replacement for Twitter and freelance exchanges. But are they good enough to become really popular?

- The target audience. How big is it? Hundreds of people, thousands or billions? For example, the audience of the "village" startup Mashkino is certainly not millions. But projects in the field of communications can count on a multi-million and even billion-dollar army of users.

- The complexity of the tasks and the reality of achieving goals. Currently, the speed of work or the global computer Ethereum no longer amazes, and sometimes vice versa. But there are all the prerequisites (as well as Moore's law of expansion) for solving this difficulty in the near future. For example, compare the Storj and Filecoin projects - their ideas are similar, but the first project has already been implemented, and the second is still not.

- What problem does the created product solve? The answer to this question will help to understand whether the development will be in demand among consumers. True, there are projects that manage not to bring much benefit to society and not solve important pressing problems, but at the same time they have been successfully working for a long time - for example, DogeCoin. The function of "bargaining chip" has already lost its relevance, which, however, does not prevent this digital money from existing and quoted. But rare companies manage to do this.

Now you know what parameters should be used to evaluate ICO projects before investing in them, and what signs indicate that the project is worthy of attention.

- The number of ICOs is expected to decrease significantly in March 2018.

- ICO regulation in the US remains controversial, and a number of projects are under investigation.

- ICOs are losing their appeal due to the increase in the number of fraudulent offers.

- Increasing the level of control could trigger a new wave of ICO popularity.

Last week I attended one of the largest digital asset events in the world - Token2049 in Hong Kong. World enthusiasts digital currencies from all over Asia, as well as from other parts of the world, came to discuss digital assets and blockchain technology. In addition, much attention was paid to the ICO mechanism - an analogue of the IPO conducted on the stock markets. To say that the number of people discussing ICOs was overwhelming is to say nothing.

More than $ 5.6 billion in funding were raised in 2017, according to a report by FabricVentures and TokenData based on their data. "This figure should be compared with the $ 1 billion of 'traditional' venture capital investment in blockchain startups over the same period and the $ 240 million generated from the sale of tokens in 2016," the report said.

A source: FabricVentures / TokenData

ICOs raise billions of dollars by selling digital assets. But in Lately these still unregulated projects have come under intense scrutiny. On Saturday March 17th, at the MIT-sponsored exhibition " Bitcoin Expo "one of the speakers Christian Catalini said:" Currently, 40% -50% of ICOs are traded below the initial offer price. "

According to news.Bitcoin.com, despite the fact that huge amounts are raised through ICOs, statistics for 2018 show that out of 74 proposals completed to date, about 76% will be at a loss. Why are so many ICOs losing money, or worse, failing? Some see the reason behind the negative performance of the leading digital currencies: bitcoin and .

However, less popular currencies such as EOS(which has grown by almost 40% over the past seven days) and Cardano(up about 12% over the same period) demonstrate that there is still momentum for growth in the cryptocurrency market.

Regulatory measures in the USA

While ICO regulation in the US remains weak and obscure, the Securities and Exchange Commission (SEC) is currently conducting dozens of studies in the digital asset space. As of March 15, the agency reportedly sent subpoenas to “dozens” of firms that it believes could violate securities laws through their participation in ICOs. Indeed, the reports note that recent SEC investigations led to an asset freeze that blocked the completion of some ICOs and forced the suspension of trading in tokens already on the market.

The Wall Street Journal reported that the number of ICOs this March will be the lowest since August last year. More than 180 placements are expected in March (data from Token Report). This number is higher than the January 175, but below the February 197 proposals. It is expected to raise just $ 795 million in March, down 45% from $ 1.44 billion in February.

What is the reason for this decline? Yoav Keren, general manager BrandShield in New York believes that one of the main reasons ICOs are currently facing is the result of phishing and online scams, which are increasingly becoming a risk factor for the industry, combined with regulatory lag in this area.

“Cryptocurrency companies face multiple threats at all stages of their life cycle... During the ICO process (which are not protected from phishing), investors and companies run the risk of losing significant funds, which are transferred by fraudsters to phishing sites. In the course of daily activities, token holders risk losing them from various fraudulent activities.

This market, in particular, is vulnerable to risk as big money and lack of governance attract fraudsters and little attention is paid to security. After all, every fraud incident has a ripple effect and diminishes confidence in the market as a whole. ”

Data onICOtransparent and widely available

Nolan Bauerl, head of research at CoinDesk, views the situation in a slightly different way. He believes ICOs offer investors the opportunity to invest in innovation by helping finance companies early on.

He concluded that the fact that we can measure their success in fundraising and ROI in such a short time is a result of their transparency and evidence of innovation. According to Bauerl, the recession is just a temporary glitch. In his opinion, the ratio of success and failure in the altcoin market is, in fact, better than in the traditional market.

Bauerl also notes that when VCs took over in the early stages of funding, the transparency we now see in ICOs was not available.

“The number of people who could ask the question about both fundraising and early return of capital was limited to a small group venture investors who were the first to know about new opportunities. This was a narrow circle of traditional investors.

Since the data onICOare now publicly available and transparent, there are many new participants and opportunities for a thorough study of the issue. All this suggests that the ratio of success and failure of ICOs will be similar to that for venture capitalists, and the main difference is transparency and the ability to openly measure this in living markets with millions of buyers and sellers.

It is worth remembering that venture capital funds agree that 90% of their portfolios are doomed to fail, which is much higher than 40-50% of failed ICOs. "

The value of tokens should not be confused with the value of the entire project, emphasizes Moshe Joshua, Development Director of Blackmoon Crypto. He believes that there is an insufficient supply of data on the supply side. In addition, many digital currency investors are prone to panic and fear of being left out. This leads to the spread of misinformation instead of accurate data and increased volatility.

“This is a common mistake in most cases. Price volatility can be attributed to the lack of a standard protocol when it comes to analyzing investment tactics.

To be more specific - there is currently a lack of supply-side research, which means that current cryptocurrency exchanges are flooded with inexperienced investors making rash decisions too easily, which as a result act as a catalyst for volatility. So, in conclusion, in most cases, the value of tokens should not be considered a metric of the success or failure of the entire project. "

ICO activity in March could really slow down. However, it appears that general opinion is that it is too early to say that ICOs are in the past. Rather, the introduction of additional regulation, combined with current or even greater transparency, could spark a new wave of ICOs.

- 1 How to evaluate a startup: why 3 standard approaches don't work?

- 2 How to evaluate ICO and other startups: 7 factors

- 3 Why is it profitable to invest in ICO startups

- 4 Basic Methods for Assessing a Startup

- 5 Recovery (costly)

- 6 Berkus method for evaluating startups

- 7 Methods for assessing the rate of return through forward value and terminal value

- 8 Methods for evaluating a business startup by value or customer profitability

- 9 Method for assessing the prospective value, calculated using multiplier coefficients: P / S, P / B, P / E

- 10 Model Ave Maria

- 11 How to use an investor's flair, or the "finger to the sky" method

- 12 Conclusions: how to evaluate an ICO

The popular word "startup" means new business project which distinguishes innovative idea... However, the last part of the definition is often discarded, and any startup is called a startup. new company that creates products or services.

One of the popular types of startups nowadays is ICO. Usually, the activities of companies entering the ICO are related to the use of blockchain technology, but the sphere can be any - banking, computer games, medicine, etc. To raise funds, such companies issue digital tokens that are sold to investors in exchange for their investments. As a rule, after a product is released to the market, tokens begin to be traded on the exchange, and if a startup is successfully launched, their value can skyrocket hundreds of times.

The key question for any startup is the assessment of its prospects, because most projects operate in conditions of uncertainty. And the more innovative the project is, the more questions potential investors have, and it is important for the startup author himself to soberly assess its prospects. Let's see how to evaluate the investment attractiveness of a startup.

How to evaluate a startup: why 3 standard approaches don't work?

There are traditional methods for evaluating a company or business. Typically, one of these approaches is used:

- market approach - the cost is estimated in comparison with other similar companies that have recently been sold (their value is determined by the selling price)

- income approach - it is based on calculating the expected income from the business

- asset valuation approach. In this approach, the value of the business = the value of assets minus the value of debt (liabilities)

But none of these standard methods can be applied to startups and ICO projects, because they have one very significant difference from a long time ago operating business... The essence of this difference: the profitability of an ordinary business has already been determined and can be estimated, and the profitability of any undertaking is a very unpredictable phenomenon. In the first case, the already achieved profitability is assessed, and in the second - only its prospects.

The task of any investor - and whenever possible - is to minimize risks. Considering that investing in startups is always associated with high degree risk, it is obvious that the profitability should be higher than usual. Usually, a return of about 10% is considered, which is given by bank deposits and other absolutely or conditionally risk-free investments.

An increase in profitability always entails increased risks, but the relationship between income and risk cannot be called linear. This attracts investors who want to find a project with moderate risk and high returns. The average statistics of the success of start-up business projects is 10%, the risk premium is 30%, and the period for the project to reach the desired level of profitability usually ranges from several months (for ICO) to 3 years. Based on this, we get the desired profitability - from 200% per annum and above.

Is it realistic to get such profitability by investing in ICO startups? More than! VC Mangrove Capital recently evaluated 200 ICOs (both successful and unsuccessful) and brought the average profitability on these projects - 1320%. Even if you just invest in different projects without analyzing them, taking into account the possible failure of some startups, it is quite possible to get a profitability of over 1000% due to the fact that tokens successful projects Will "skyrocket" in price hundreds of times.

How to evaluate ICOs and other startups: 7 factors

An investor, when deciding to participate in a startup, evaluates it according to the following parameters:

How much the product is in demand for the target audience.

- Availability of a finished product (analysis of the current stage of a startup)

- Project risk analysis.

- Ability to control the progress of the project

- Expected rate of return

- Team analysis (do they have successful launches behind them)

- Analysis of the market niche to which this project belongs (it is best to invest in a growing market)

It is necessary to carefully analyze each of these parameters and honestly answer all questions in order for the project assessment to be objective. More important is the stage at which the startup is. A “brilliant idea” in itself is worth little - it all depends on how it will be implemented.

Why is it profitable to invest in ICO startups

Since 2017, ICO projects have become one of the main trends in the financial market; they raise several billion dollars annually.

ICO - risky projects, but the level of risk can be reduced if you conduct a competent analysis of the project. There is no “secret” of the popularity of ICO projects: investors are always attracted by the possibility of obtaining super-profits. Many projects going to ICO offer truly revolutionary products in the most different areas: medicine, media, computer games, bank cards. Many projects already have a promising product, but collect money to promote it and scale the business. Unsurprisingly, over time, their tokens rise in value (as the value of shares in successful companies increases).

Let's take a look at how to correctly evaluate ICOs and other startups so as not to get screwed up.

Basic methods for evaluating a startup

It is believed that first of all, it is necessary to analyze the potential of a startup. business expert... What methods can be used in this case?

Recovery (costly)

This method estimates only the financial costs of creating a similar product on the market, and specifically

- the cost of labor of specialists involved in the project;

- costs of patenting and other formalities;

- assets and funds of the project;

- marketing, advertising and other costs.

Typically, a startup's estimate based on this method is underestimated. If an investor wants to bargain, then it is profitable for him. Such an assessment does not take into account the growth of the project's potential, which can “shoot”. But the restorative method allows you to determine how effectively the funds are spent on launching and promoting the project.

It is hardly reasonable to use this method for evaluating ICOs, because key indicator for these projects the potential of the product, the possibility of realizing this potential and the analysis of the sales market are considered, and the restoration method does not take into account these factors.

Berkus method for evaluating startups

This estimation method has existed since 2001. The restorative method is taken as a basis, but some additional factors and allowances are applied to it, for example

- For a promising idea - from 20% to 40%

- For project management (if it is professional) - from 20% to 80%

- Per unique position on the market - from 10% to 20%

- For the presence of a realized prototype (it reduces technological risks) - from 20% to 40%

- For CashFlow (cash flow) - from 20% to 40%

Sometimes the premiums according to this method are estimated not in relative, but in absolute terms, in other words, in money.

This method is considered empirical, that is, largely subjective. But it can be used to evaluate ICO projects.

Bill Payne's method (aka the method of scoring, benchmarking)

The author of this method was Bill Payne, the famous investment "angel".

At its core, the method is similar to the Berkus method, however, it is more tied to specific conditions. Used to evaluate companies at the development stage (before the first income is received)

The analyzed company is compared with other startups in two stages.

First stage. First, the average rating of the company is determined (in this niche and in this region). True, in the conditions of Russia, such data are not publicly available, but if you wish, you can find them.

Second phase. Application of the scoring method, that is, comparing the acquired company with the average data and taking into account the coefficients that also affect the valuation cost:

- Strong team, management and management: + up to 30%

- Market size assessment: up to + 25%

- Technology / product novelty: up to + 15%

- Competitor analysis: up to + 10%

- Evaluation of marketing, partners and sales channels: up to + 10%

- Do you need additional investments: up to + 5%

- Other factors: up to + 5%

It may seem surprising that product and technology novelty is ranked lower than team and market relevance. But do not forget that in any business the quality of the team plays a decisive role and usually becomes the key to success. When it comes to the sales market, the ability to increase sales in the future is very important for generating revenue from a startup.

Thus, if a company is valued at $ 1 million, but in terms of additional parameters and coefficient it has gained another 15%, its estimate is $ 1.15 million.

The key factor here is an accurate and objective understanding of the average valuation of similar companies in your area.

As for ICOs, this method can be used for evaluation, and it can be quite accurate if all additional coefficients are correctly evaluated. It largely depends on them how the company's digital tokens will skyrocket in price.

Methods for assessing the rate of return through forward value and terminal value

There are two methods of assessment - through the calculation of the future value (forward value) and the final value (terminal value).

Assessment of the future value of investments (forward value)

According to this method, the cost of an investment after a few years can be calculated using the following formula:

Present value of investment * (1 + target rate of return) * number of years

For example, with a 40% annual rate of return and an investment period of 2 years, the cost of a $ 100,000 investment when the investor leaves the project will be $ 100,000 x (1 + 0.40) * 2 = $ 280,000

The most difficult thing is to correctly calculate the objective annual rate of return.

Assessment of the final cost of investment (terminal value)

The easiest way is to just look at a similar company (competitors) and substitute the necessary indicators (sales volume, number of customers) in the calculation formula in order to calculate the cost of a startup at the moment when the investor plans to withdraw his funds.

Both of these calculation options assess, first of all, the efficiency of investments, and not the cost of the project itself, but this is of paramount importance for the investor.

For the evaluation of ICO projects, this method is less suitable than the Berkus method. Although if the project has a competent and substantiated business plan that allows you to accurately predict the indicators needed for calculations, it can also be applied.

Methods for evaluating a business startup by value or customer profitability

This method is suitable for evaluating companies, if the notional “value” of each client is more or less constant, then where there is no large variation. Examples include the operators mobile communications- data on subscriber spending is quite accessible, so it is quite easy to estimate the future cost: for this, the estimated number of customers must be multiplied by average cost a check from each of them. True, here it is necessary to take into account the possible risks.

This method is considered one of the most accurate. It is based on standard grade profitability, which includes:

- average profitability of each client

- assessment and calculation of the number of clients by a certain moment

Example: Average income from each client is $ 8 / year. The price for attracting a client is $ 3. If advertising budget is $ 100,000, for this money you can attract 33,000 customers. Based on this, the income from the project for the year is $ 264,000 / year, and its cost in 365 days can be estimated at $ 792,000 (it is equal to the profitability of the project for three years)

Both of these methods can be used if the project allows you to accurately determine the number of customers and the "average bill".

The method for assessing the prospective value, calculated using multiplier coefficients: P / S, P / B, P / E

The most popular calculation option is the P / S ratio (capitalization to revenue ratio) multiplied by 2-4 times.

The resulting indicator is compared with the multiples of the companies that are traded on the stock exchange.

This method is not suitable for evaluating ICO projects, because it is not used in the early stages of starting a startup.

Model Ave Maria

The Ave Maria model (the name is a slightly distorted abbreviation of English words) was invented by M. Krainov.

The project is evaluated according to the following parameters:

- Acquisition - new customers. Assessment and characteristics of the audience, how many people, what channels are used to attract them.

- Value (although here Cost is more precise - costs). Average, as well as the maximum possible cost of attracting customers, and the factors influencing it.

- Engagement - how the client gets involved in the project. Preferred actions for each user, interaction of clients with each other.

- Monetization - how should clients bring profit to the project and at what point?

- Retention is the answer to the question of how to turn a customer into a permanent one, how to “screw up” one-time sales to regular ones.

- LCV is the total amount of money the client will bring to the project.

- Intellectual Property - measures to protect your idea from copying and theft.

Using this model, it is convenient for an investor to compare several projects and choose best project for investment. It can be used for ICOs if you choose two or more similar (similar) ICO projects - for example, for a project for the issuance of debit cryptocurrency cards. A competent analysis will help to find out whose tokens will be more promising.

How to use an investor's flair, or the "finger to the sky" method

Experienced investors with a good nose for profitable investments can make decisions about investing in a startup based solely on their intuition.

The method is completely unscientific, but it still works for the “guru”. True, here it is important not to overestimate your capabilities. Experienced investors really have a nose for profitable startups and can determine which tokens will make them millionaires.

Conclusions: how to evaluate an ICO

Let's summarize how to analyze the prospects of an ICO startup.

- To assess the current cost of an ICO project(for example, based on the funds invested in it, or on the basis of similar companies in the market - if such already exist) and objectively analyze 7 key factors that affect the success of the product in the market. This can be done using the Berkus method or the Bill Payne method. Thus, by applying correction factors, you will predict the cost of the project in a few months or years, when the product is already on the market. When the value of a project rises in value, its tokens also rise in price.

- To assess the future and final cost of an ICO project investment, you can use assessment methods through terminal value and forward value. This method is suitable for ICOs that have a clear and well-founded business plan with all the necessary metrics such as a rate of return.

- If the price of the product and the number of customers are known, you can apply the method of calculating the profitability and customer value.

- To compare two similar ICOs and choose the most promising of them, the Ave Maria method will do.

None of the above methods give the opportunity to 100% objectively assess the capabilities of a startup. It happens that experienced investors “get into a puddle”, but their difference from newbies is that investors never put all their eggs in one basket (in other words, they don’t buy tokens of just one ICO project), and income from profitable investments usually significantly cover losses from failures.