According to statistics, most motorists purchased their car using bank loans. It should be noted that the cost of a vehicle is quite high and it is almost impossible to buy it without attracting a loan.

But the first question facing a potential buyer is where and how to get a loan for the purchase of a car. First, the buyer studies the car loan market, because this is a targeted program, which means that its conditions will be economically beneficial for the borrower. Others, on the contrary, believe that the conditions for car loans are quite harsh and it is much easier to take a consumer loan and buy a car using borrowed funds. Let's compare two banking products and try to determine as accurately as possible which loan is more profitable than a consumer or car loan.

A car loan is a targeted program, that is, a bank issues a loan for a specific purpose - buying a car, while the lender has several essential conditions. That is, here the bank significantly limits the wishes of the buyer. We will analyze all the conditions for car loans.

Car requirements and deposit

The first of these is the requirements for the car. Many banks have a number of requirements for the purchased car, or even credit conditions will depend on the chosen brand and model of the car. Lenders are more willing to invest in the purchase of a new foreign-made car, since they have established themselves among users as more reliable and proven.

It is not for nothing that banks impose special requirements on the car, because for the lender, first of all, it is the subject of pledge. That is, after registering the transaction, the vehicle passport will remain with the lender until the borrower fully fulfills his obligations. And if we take into account that the loan agreement is concluded for several years, the bank needs a guarantee that during this period the collateral will not lose its value.

Please note that the car is in use by the borrower, but he cannot make any transactions with him: sale, gift, pledge.

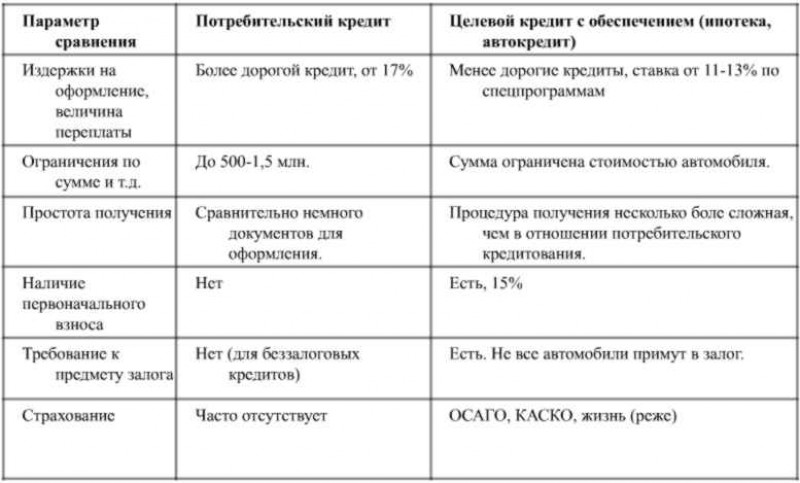

Interest rates and insurance

To determine what is better for a car loan or a personal car loan, you need to compare interest rates. These can vary greatly depending on the bank you choose, and the choice here certainly depends on the borrower. First, let's take a look at what criteria determine the amount of interest:

- the initial payment, the minimum, as a rule, is 10-15%, but the more the borrower is ready to pay from his own funds, the cheaper the loan will cost him;

- wages and other income of the borrower, or co-borrower if their own earnings for obtaining a loan will not be enough;

- insurance of personal risks, that is, life and health;

- car insurance under the CASCO policy;

- credit history.

The fact is that the rate for each loan determines the degree of the borrower's risk, the lower the risk, the lower the rate. Therefore, the bank is ready to provide the best conditions for a car loan to a borrower if he is ready to pay about half of the cost of a car, he has a high level of income, and a positive credit history. As for insurance, CASCO is a guarantee against the loss of the collateral, with this form of insurance the bank has a much lower risk, and for the borrower it is a rather costly security measure, because the policy will cost him about 4-12% of the cost of transport. Personal risk insurance is an optional type of insurance, but with it the rate will be slightly higher, from 0.5-2%. On average, rates range from 15 to 25%.

Please note that insurance is carried out at the expense of the borrower's own funds, although banks offer to include CASCO insurance for the first year and personal insurance with the cost of the loan.

It is worth immediately focusing a little on your credit history. Owners of a positive reputation may not think about which loan to choose consumer or target, because both banks are likely to approve. But if there are “dark spots” in the report, then it is wiser to immediately apply for a car loan, because the bank will have at least some guarantee, in the form of collateral, that it will not incur a loss, and will most likely refuse a consumer loan altogether.

Car loan registration

Let's see how you can get a loan to buy a car, by the way, the procedure can differ significantly depending on the bank's policy. First, you need to familiarize yourself with the bank offers and choose several options for car loans, and you should definitely study the requirements for the acquired property so that it fully corresponds to the option that you have chosen for yourself.

Then you need to submit an application to the bank and prepare all the documents that will confirm your solvency. In case of a positive decision, you will need to transfer the amount of the initial payment to the seller's account and conclude a sale and purchase agreement, then appear with him and a payment document, which confirms the fact that the buyer transferred part of the cost of the car to the seller, and sign a loan agreement. By the way, do not forget the TCP, it will remain in the bank. At the end of the process, the lender transfers the money to the merchant's account.

In practice, everything looks a little simpler, provided that you buy a new car, because, as a rule, this process takes place quite quickly right outside the walls of the car dealership. After all, any car dealership cooperates with several banks, so the procedure will be simplified, here you can apply for a CASCO policy.

By the way, before insuring a car, check with which company it is better to do this, because banks also cooperate with insurers, and only accept policies from credited companies.

Car loan cost

The most important question is how much the car loan will cost in the end. Let's consider this issue with an example:

- the cost of the car is 1 million rubles;

- loan rate 17% per year;

- an initial payment of 20% or 200,000 rubles;

- CASCO cost - 50 thousand rubles per year;

- term - 5 years.

So, the amount of a car loan is 800 thousand rubles, the total cost of the loan is 1192924 rubles, the monthly annuity payment is 19 882 rubles. CASCO insurance must be added to the cost of the loan, for five years it is 250 thousand rubles.

In total, we consider how much the car loan will cost to the buyer in the end: 1192924 + 200000 + 250000 = 1642924. According to these preliminary calculations, the surcharge will leave 642924 rubles.

Consumer loan

This type of lending involves the misuse of funds. That is, the car will not be pledged by the bank, it will not require a CASCO policy and a down payment. And the most basic benefit is that you don't need a down payment.

Advantages and Disadvantages of Consumer Lending

First of all, the main advantage over a car loan is that it will not be difficult to arrange a non-targeted loan in every bank, because every financial institution has this product. The second advantage is that you have a better chance of getting favorable terms. Consumer loan rates also depend on several factors, for example, on the solvency of your credit history.

If we talk about the shortcomings, then the first of them, if you need an amount of more than 500 thousand rubles, then the lender will most likely require a pledge or surety from individuals. Real estate can act as collateral, but here there is already a great risk for the borrower, because in case of non-payment of the loan, the property will go to the lender.

Please note that the bank will independently determine the maximum loan amount for you based on your income, which also limits your options, if you have chosen a consumer loan, then choose an offer where the bank allows attracting co-borrowers.

The process of registration and purchase of a car with a consumer loan

The procedure here is pretty straightforward. You can start the process by choosing a banking product, and, by the way, at the same stage, submit applications to several credit institutions, then choose a more advantageous offer. If you want to get the most favorable conditions, then prepare all your personal documents in advance, including a certificate of income and certificates of ownership of property, this will help you to confirm your financial solvency as much as possible.

Comparison of consumer and car loans

After the bank has given a decision, and you have chosen the offer that suits you best according to the conditions, you can go to the bank with a package of documents and conclude a loan agreement. After receiving cash, you can choose and buy a car. There is a second option for your actions, you first look for a car and determine the price range, then go to the bank and get a loan, and after transferring funds, you make a deal. It doesn't really matter in what sequence you act.

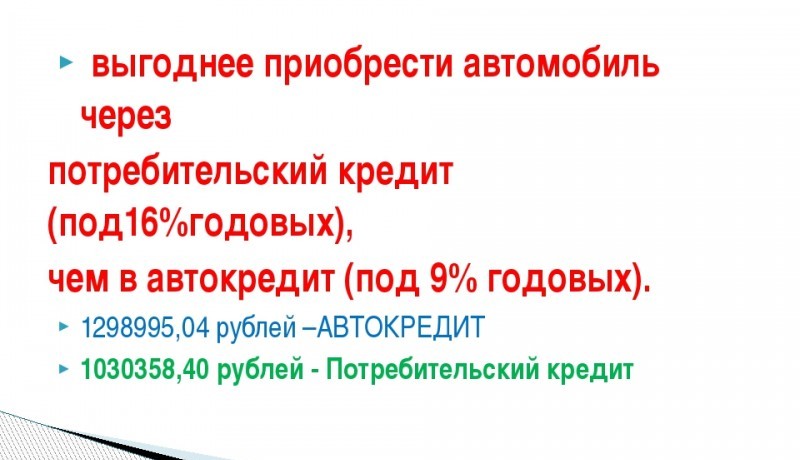

Consumer loan cost

To clearly understand what is more profitable for a car loan or a consumer loan, consider the same example:

- amount - 1,000,000 rubles;

- rate - 17%;

- term - 5 years;

- OSAGO insurance - 15 thousand rubles per year.

For the specified period on the loan, you will pay the bank only 1,491,155 rubles plus 75 thousand rubles of insurance, a total of 1,566,155 rubles. And this is 76,769 rubles less than for a car loan.

Which is better to choose

Let's summarize which loan is more profitable to take for the purchase of a car. In fact, everyone will decide for himself. If you have start-up capital, and you can easily pay part of the cost of a car yourself, then there is no point in overpaying interest on a consumer loan to the bank, in this case it is wiser to take out a loan under a specialized program. And when there is no amount needed and it is problematic to accumulate it, then there is nothing left but to turn to the help of consumer lending.

Another nuance is that CASCO insurance for a credit car is a reasonable decision, because not only the bank, but also the borrower himself significantly reduces the risk of damage to his property. In addition, it must be borne in mind that the vehicle for many years of repayment of the loan may be lost as a result of unforeseen circumstances, and the obligations to the bank will remain. Here CASCO reduces the risk of the borrower and the lender to incur large losses.

A consumer loan is undoubtedly beneficial in terms of its terms, because the lender does not impose requirements on the purchased property, which significantly expands the potential of the buyer. By the way, it is possible to get a loan at a minimum interest rate in the bank in which there is a positive lending experience or the borrower is a salary client.

So, for starters, the borrower should carefully study the current proposals for consumer lending and car loans, calculate their benefits on a loan calculator. As for the rates, they are approximately equal for both types of lending.