In the article:

Sberbank offers a wide range of cards for its customers. From the category of privileged, it stands out favorably Sberbank gold cardVisaGold which can be debit or credit .

How to get a Visa Gold card

Debit cardVisaGold in Sberbank provides special advantages and privileges to its holder:

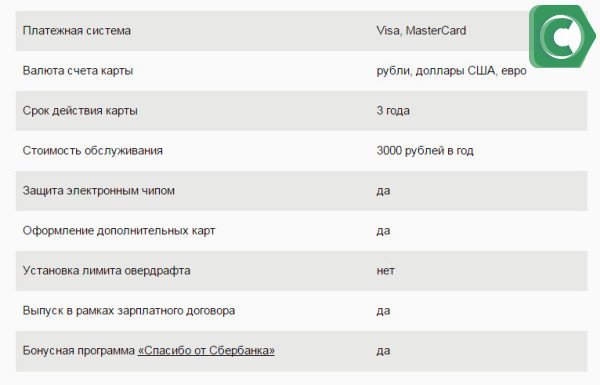

- Currency: rubles, euros, dollars.

- Electronic chip protection.

- The possibility of issuing additional cards, including for a child who is 7 years old.

- The action of the "Thank you" bonus program.

- Cash withdrawal and service on the same terms in the country and abroad.

- Discounts and promotional offers are everywhere, incl. Abroad.

- Issued as a salary card.

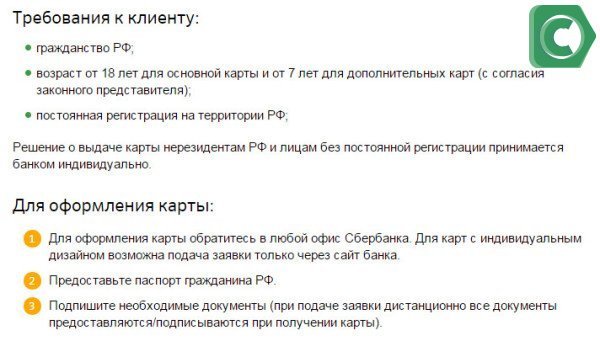

To be able to use this product, you must be of legal age, be a citizen of Russia and have registration. In case of non-observance of the last two points, the issue of the card is also possible. In this case, Sberbank makes a decision individually. The issuance procedure is as follows:

- Visit the office or apply online.

- Show your passport to the employee.

- Fill out an application.

- After receiving consent (no more than 2 days), sign the contract.

When sending an application online, the client is invited to the office to sign the necessary papers. If you want to get a product with an exquisite, unique and original design, you only need to submit an application online.

Terms and benefits of the Visa Gold card

Maintenance of the product costs 3 thousand rubles a year, a card is issued for 3 years, after which you can close the account, get a similar product or renew the contract for the existing one. You can replace an existing card, including ahead of schedule, without applying a commission.

For large clients, it is sometimes a disadvantage that the card has a limit. For Visa Gold in Sberbank, it equals 3 million per month or 300 thousand rubles per day. If you exceed the daily limit, commissions will be deducted during transactions. It will be 0.5% in the services of Sberbank and 1% when using devices from other institutions.

MapVisaGold in Sberbank, advantages and disadvantages which is obvious to the client from the above, has many ways to replenish:

- Transfer money through an employee of Sberbank. You will need to voice the number of your card or its account. In the first case, you need to confirm your credentials with a passport, in the second, you need to know the details of the regional institution that issued the product.

- From another card of Sberbank. It is allowed to use ATMs or Sberbank terminals. When the corresponding services are connected, the operation takes place via a mobile application via SMS or Sberbank Online.

- Deposit cash into the account through the terminal or ATM (cash-in).

- Transfer from a card of another financial institution. To do this, you will need to indicate the details of the Sberbank that issued the card, its number, account number and your last name. Admission is carried out on this day or the next.

- Through the Visa Direct service. It is allowed to transfer online (smartphone, Internet), as well as in cash through a terminal or ATM. With the latter, you can use both Sberbank devices and other institutions. Performing the procedure, you just need to indicate the card number. The operation takes place instantly. In exceptional situations, delays may occur, but no more than 3 days.

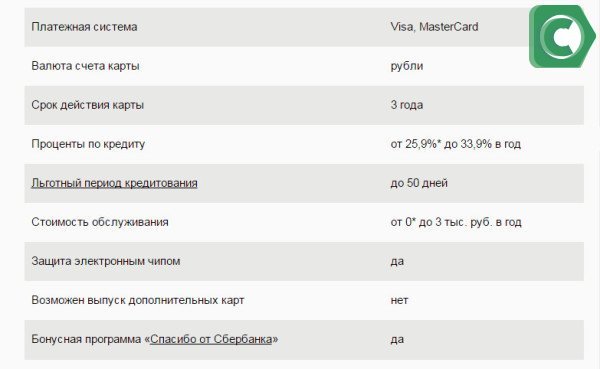

Conditions and features of the Visa Gold credit card

The benefits of a Visa Gold card with Sberbank apply to a similar product in the credit category.

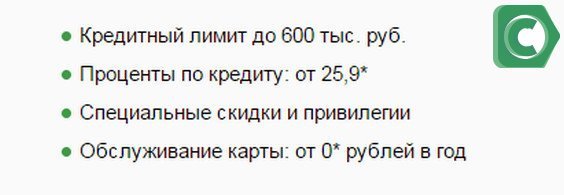

The credit card is designed for a limit of up to 600 thousand rubles. With free service of the card, a percentage of redemption is provided from 25.9%.

There is a possibility not to pay interest on the debt if it is repaid on time. This is given 50 days. After thirty of them, the bank generates a report and sends it to the client. Knowing his debt, the client can pay it back in 20 days. Also, he may not wait for the report, but pay it any day. If it does not exceed the specified period, interest is not charged.

Sberbank credit cardVisaGold, conditions which are described above, is subject to registration under the conditions that the client is 21 years old and has a permanent place of work. Moreover, his work experience should be more than six months at work, where he is currently registered, and more than a year in the previous several years (5). The borrower needs to secure the following securities:

- the passport;

- certificate 2-NDFL, which contains data for six months;

- papers characterizing the borrower's income in the form of the employing company (if there is no 2-NDFL);

- certificate of the amount of pension payment for six months (for a pensioner);

- papers explaining the client's employment.

The latter can be any document: a labor book, a contract with an enterprise (certified by seals), a certificate of an individual entrepreneur certified by a notary and other certificates explaining the type of occupation (lawyer's certificate, license, etc.).

The stages of issuing a card are as follows:

- Visit the branch.

- Fill out an application.

- Submit copies of all required papers.

- Get permission (after 2 days) or refuse.

- Sign a contract.

- Get a card.

Visa credit card benefits Gold

Credit cardVisaSberbank Gold, advantages and disadvantages which is quite understandable, if you study the tariffs and terms of repayment, it provides more additional opportunities:

- The borrower can enjoy the privileges and discounts that the Visa system gives to all its clients.

- Using remote resources to get advice, solve problems, conduct transactions (Contact Center, Sberbank Online, Mobile Bank).

- In case of loss of the product abroad, the possibility of receiving cash in a short time.

- Payment for utility services, mobile communications, etc. (Auto payment service).

- Connection of a secure system for remote operation (Verified by Visa).

- Payment via ATMs, self-service devices, the Internet in the Russian Federation and abroad.

- Several options for replenishing the card, incl. transfer from others.

- Possibility to link the card to online payment systems (Yandex Money).

It is quite simple to figure out how to use a Visa Gold credit card from Sberbank. The client will need to present it when paying at retail outlets, enter details for online transactions, or use SecureCode to use secure payments.

To control their operations, limit, balance of funds and receive other information on the card, the borrower has the right to use any services of Sberbank:

- if you subscribe, a report will be sent to the online mail address every month;

- if you connect the Mobile Bank, messages are sent to the phone number that notify the client about the nature and amount of the transaction (more about);

- if you receive a password and an identifier (login), you can generate a report in Sberbank Online at any time for the period of interest;

- you can contact a specialist of the Sberbank Center (for more details in the article -), who will provide any information. You will need to give the card number and possibly the secret code or its details.

There are also such proposals for Gold credit cards in Sberbank:

Similar services can be used when owning a Visa Gold debit card from Sberbank, the advantages and disadvantages, which we discussed in this article.