Many people dream of owning a personal car, but not everyone has the opportunity to purchase a vehicle right away or accumulate the required amount in a short period. It is in such a situation that one of the options for solving this problem is to contact a credit organization for a loan. Today there is an opportunity to obtain both a consumer loan and a car loan to buy a car. But it is important to remember that the lender is interested in making a profit from interest rates and other payments that the client makes for using the borrowed money. This article will help the reader to understand which loan is more profitable and better in 2017, as well as to get advice from experienced specialists.

What is better to take a car loan or a consumer loan

Depending on the purpose for which the borrower wants to take money, loans are distinguished:

- target;

- non-targeted.

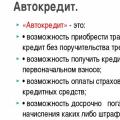

One of the options for a targeted loan is a car loan. As in the case of obtaining another similar loan for a car loan, the client will not even be able to see the borrowed money. The fact is that the amount specified in the contract is transferred to the current account of the car dealership in which the purchase of the car is planned.

Car loan or consumer loan: comparison of conditions

It cannot be said with certainty that any of the loans is better and unambiguously more profitable. It all depends on certain conditions in which the borrower is willing to buy a car.

Considering the requirements for, the main disadvantages should be noted:

- obligatory initial payment;

- transfer of the TCP to the bank;

- registration of CASCO without fail.

What is better car loan or consumer loan reviews

Alexander:“Having recently repaid a car loan, I want to say that he has only one plus. If you have no patience to accumulate the necessary amount, then your car will be faster. For the rest, there are only drawbacks. It is advisable to take a consumer loan for the purchase of a car, and it is even better to save money before registering it, then it will be even more profitable. "

Valentine:“A car loan is a good thought out thing. The interest rate is lower than inflation, so the car itself is cheaper compared to saving for more than 3 years. But you have to overpay a lot for CASCO, but you don't have to be afraid for your new car. "

Peter:“I took a car loan at 26% per annum. Paid for two years for 40 thousand rubles. And I don't regret anything. I don’t know how to save, but the car earns for itself. The main thing is to calculate your capabilities correctly and choose a reliable and honest bank. "

Date of data update - March 2016.