LTV, or LifeTime value, is an important indicator in marketing activities... Of course, any company wants to work successfully and effectively promote its services on the market. To do this, she needs to pay due attention to the formation of a competent marketing policy in the Internet environment and give preference to effective advertising strategies.

In many areas, the cost of acquiring a customer turns out to be higher than the cost of his purchases. Therefore, first of all, you need to work on increasing consumer loyalty and make every effort to ensure that a person wants to contact the company again. In this case, the firm begins to receive income from the client only with 2-3 cooperation. The LTV indicator helps to understand how much it will be rational to spend on attracting each new buyer in a highly competitive environment.

The American company HubSpot found out which first sentences do not inspire the reader, but, on the contrary, force them to delete the letter.

In our article, we have collected 5 such phrases, and ways to fix mistakes.

- Download a sample cold call script based on Steven Schiffman's methodology

LifeTime value - what is it

LifeTime value ( English Lifetime Value) is part of the SaaS space. Today, it is the LTV index that is most interesting for marketers to research. At the same time, LTV is very difficult, both in terms of calculations and in assessing and applying the results. How do you get LTV and how do you use it?

LTV, or LifeTime value is the amount Money that a specific client is supposed to bring to you during the period of cooperation. For example, the cost of your services is $ 100 per month, and you plan to interact with the customer within a year. So his LTV is $ 100 x 12 = $ 1200.

In LTV-based cloud marketing, you calculate the amount you can spend on acquiring new customers. For example, if to attract one customer, or CAC ( customer acquisition cost) you will spend $ 100, and its life cycle will be equal to $ 500, after calculations your profit will be $ 400.

The higher the LTV and the lower the CAC, the faster you earn.

But not everything is so simple. In general, the circuit is correct, however, for long-term operation this is not the best way... There are many reasons for this, and one of them is significant differences in clients.

First of all, you should be aware of the LTV of all segments of your products. When it comes to SaaS, segments are identified based on the cost of the service package. For example, Nikolay's LTV, which has a monthly tariff plan of $ 30, differs significantly from Mikhail's LTV with his $ 200 a month. And the difference is not only in the price.

With LTV you can

Define real ROI in terms of the cost of attracting a new customer. At the expense of LTV, you will select the most effective channels for attracting a paying audience. It is certainly wiser to improve your marketing channels based on the profit you receive from the customer over the life of the customer, rather than on the income from their initial purchase. Accordingly, you will have the opportunity to maximize the lifetime value of the customer relative to the cost of acquiring a new one (CAC). If you do this, your audience engagement strategy will change completely.

It is possible that you will see on your part unnecessary costs for these goals. At the same time, you will learn not only about how much profit one purchase brings, but also about how much the consumer allows you to earn for the entire time of interaction with him. With high LTV customer data, you'll know exactly who to target. This will allow you to bypass competitors who do not have such information.

Improve strategy customer retention... The value of a marketing campaign (for example, one that turns a random customer into a repeat customer) should not be based on current income. The value should be assessed in terms of the impact on the average LTV in the consumer segment you are targeting. How does this change the trajectory of LifeTime value that the average customer brings? For calculations, you need accurate analytical data. Only in this case it will be possible to study how different marketing activities change LTV.

Create more effective messaging, targeting and customer information Comrade Estimate your audience and assign people to groups based on LTV. You can make your marketing campaigns more effective by using personalized messages. An important variable that applies in this case is the types of products that you sell to consumers in different segments.

To improve behavioral triggers. Through the use of cluster techniques, you will be able to find new behavioral triggers that stimulate your customer to buy a product for the first time. It will be possible to take advantage of this behavioral factor with new potential consumers, encouraging them to make their first purchase.

Improve productivity through customer support. Pay attention to your best clients. There are significant differences in consumer life cycles for one reason - churn. Typically, significant churns occur in the segment of users with low tariff plans... Keep this in mind when calculating the LifeTime value for each category.

As noted above, thanks to LTV, it is possible to understand how much a company can spend on finding and attracting an audience. For example, if the average user costs $ 220 and the expected profit is $ 100, it makes no sense to collaborate with such a client. That is why accounting for churn for each customer group when calculating LTV is so important.

- LTV score: 3 formulas for calculating customer lifetime value

5 LTV steps to manage customer lifecycle

Step 1. Segment customer base.

At the heart of LTV marketing is identifying customer groups that behave in a similar way. Companies use a number of techniques to segment their audience.

The classic segmentation of the Boston Consulting Group, created more than 50 years ago, is often used. According to it, buyers are divided into groups: "brown bears", "sleeping marmots", "cash cows", etc.

But the most rational, which allows you to get the most accurate data, is RFM segmentation. This method is based on 3 parameters.

LifeTime value is calculated over a certain period of time. It is directly influenced by the cycle of use of the company's products. In other words, the duration this period depends on the frequency of purchases. The more often purchases are made, the shorter the counting period should be. For example, in relation to products that are purchased every day, this period is six months. If we are talking about high-value goods, it is longer. So, for the sale of clothes, the period is one year, since they are rarely bought.

Metrics (RFM) can be combined in different ways. It all depends on the length of the period covered. In the future, the indicators need to be distributed across 5-6 large segments in order to make it convenient to work. Customer classification can be based on the similarity of the transformation rate. Based on an analysis of customer acquisitions of a certain point of sale within a year, you can develop a table following the example of table 1. Months during which consumers did not buy anything are indicated by 0, months in which purchases were made - 1. Customers were divided into 5 groups.

Based on the data shown in the table, you can guess what the likelihood is that a consumer from each group will buy something within a certain time. For example, those who have not decided on what to do may or may not purchase the item next month. At the same time, customers who have already made purchases more than once will buy something again, since, apparently, they are satisfied with both the assortment and the price.

From all of the above, a reasonable conclusion can be drawn. Since the ability to determine whether a purchase will take place or not is different for a particular segment of consumers, influence these segments with the help of marketing methods also follows in different ways.

The next step is figuring out how to manage segments and choosing marketing tools for each.

Step 2. Determine the key goals of LTV marketing.

So, customers are divided into segments. Next, you need to analyze the performance of each segment. Good and very good customers are given quite a bit of space in the database - 6% and 2%. However, it is thanks to them that the company manages to sell most of the goods (33% and 30% of the total).

With this information as a basis, you will set new marketing goals. For example, if you increase your percentage of very good customers by 0.1%, your sales will increase by 3%. At the same time, consumers who have not yet made up their minds will help increase sales by only 0.6%.

Conclusion - it's better to invest in increasing the number of very good clients.

This information helps answer the main questions in LTV marketing:

- how high-quality the client base is in the ratio of active and passive consumers (information is reflected in the "Transformation rate" column; here it is 8% of active consumers, which is generally not bad);

- to which clients the company directs the main funds of the marketing budget and how much (you can find out about this thanks to the indicator "Share of the segment in the base"); if the marketing budget funds are not allocated to groups, the costs for all consumers (both "good" and "bad") will be the same; while the firm should not spend about half of the budget on "sleeping" clients;

- what is the ratio of marketing costs and consumer value for the enterprise (stimulation is required for high-income segments of the base, reflected in the indicators "Share of the segment in the volume of sales");

- which of the segments needs growth and development (as a guideline, you can take "Number of purchases", " Average cost purchases "and" Gross Profit Per Active Client ");

- what goals the business owner pursues when cooperating with these consumers, and what KPI is his marketing actions aimed at (first of all, it is necessary to increase the number of profitable customers).

Step 3. Managing the customer life cycle.

The company should study the life cycle of consumers, that is, understand how they move from one segment to another. If you have this information, you will better understand which marketing activities are more rational. The basis of a particular marketing strategy should be the ability of the client to move from segment to segment. For this, a transition scheme is developed for a specific period, for example, a month.

It is necessary to understand the peculiarities of the behavior of new buyers. Only 10% of consumers re-purchase a product or service during the study period, moving from the category of new to the category of good customers.

If the difference in sales and income between categories is very significant, even the slightest increase in conversion will affect sales. Lost sales are found right here: customers move into the undecided category with much poorer characteristics.

Only 7% move from the undecided segment to the good and very good groups. At the same time, the outflow from the very good segment is 36%. From the undecided category, 13% of customers stop buying the company's goods or services, leaving for the sleeping segment. The number of people waking up is only 3%. When you supplement this information with information about the volumes and amounts of purchases, it becomes clear that most of all the company should value customers whose life cycle has gone through the categories of good and very good. That is, the basis for the formation of an LTV marketing strategy should be the distribution of consumers by categories and an awareness of how they move from one category to another.

Step 4. Set goals and develop LTV marketing strategies.

At this stage, they determine what goals need to be achieved when working with a particular segment. Also here they form marketing proposal, evaluate on what channel and at what time it is better to interact with customers. In addition, the company creates a budget for marketing goals determining how much money she is willing to spend on which consumers.

This marketing strategy is based on the principle that the firm should strive to transfer the maximum number of new customers to the good category, increase the number of this category and keep the indicator at the same level for a long time. Competent work should be done to ensure that as few buyers as possible go into the undecided category. With all this in mind, the company should use appropriate marketing tools.

Universal marketing tools not yet created. For example, it seems that the 50% discount always works. However, according to the test results, customers of the “very good” segment purchase products without discounts. That is, they do not need additional incentives. When a company provides a discount, it only loses money and creates a situation in which it will be difficult for it to sell the product in the future without additional incentives.

- New clients. In a good way an incentive present, or welcome pack, will increase consumer loyalty. The seller, along with the first order, sends a small gift and an NPS questionnaire, which motivates the client to make a new purchase.

- Good clients. They can deliver orders for free and periodically send e-mails along with personalized recommendations. The mailing list should be started one month after the client last bought something. It was during this period that the risk of his transition to the undecided segment is especially high.

- Very good clients. Consumers in this segment should be encouraged with birthday gifts. It is better to serve them in the call-center out of turn or individually. Clients must have a personal manager. Please add attachments to all orders upon shipment. Communicate with very good segment consumers no more than once a month and a half.

These buyers are the most expensive for the company in terms of marketing costs. These costs are 6 times higher than costs for new customers and 2.5 times higher than for a “good” audience. The costs for each individual category depend on the income that it is expected to generate.

Step 5. Eliminate marketing mistakes at stages life cycle client.

Starting to use LifeTime value in marketing, you can make certain mistakes, due to which the events held will not be as effective.

- Incentive for customers who have just made a purchase. Do not forget about the so-called natural period of demand among consumers (the time period after which a person again tunes in to a deal). If you attack a customer without waiting enough time, he will behave unnaturally, and after you stop pushing him to buy, the parameters will only deteriorate. It would be wiser to track after which period the consumer purchases the goods again, and leave it alone until the end of this period.

- Organizational separation of marketing from the rest of the company. The role of customer service is difficult to overestimate when it comes to keeping customers in the best segment. Don't waste your money on discounts for good customers. Better invest in quality customer service and try to find an individual approach to each consumer. If these conditions are met, there will be no problems with retaining good and very good customers. In this sense, it is very convenient to use a CRM system, which allows at each stage of interaction with a customer to find out in which segment he is at the moment. If the company has such information, it will provide the appropriate customer service. If difficulties arise at one of the stages of communication with a consumer, you will know who this person is and how to work with him. This approach to the client today is the pinnacle of LTV marketing.

- Ignoring the impact of customer acquisition channels on their life cycle. Marketers usually measure how effective acquisition channels are based on the cost per customer metric or per purchase. However, it is better to focus on the life cycle of consumers entering through different marketing channels. The result in this case is more reliable. For example, the number of customers who bought products for the second time (that is, moved from the category of new to good ones) and came from channels for comparing prices for goods is 15%. The share of consumers who came through the "call-center" channel is 24%, through partner channels - 38%. Note that the most costly in terms of attracting customers are precisely partner channels.

- Lack of involvement of top management. If the management is not interested in LTV marketing and does not understand that after mastering it, it will be possible to significantly increase the efficiency of the company, you should not even try to implement this system. LTV marketing cannot be trimmed down. When implementing it, you need to accurately verify the parameters, carefully and effectively interact with all categories of customers, constantly conduct tests, calculate the results, and build business processes for each segment from scratch. If the company is not ready for these and other events, there is no need to start working with LTV.

Based on the article by Juliana Gordon How to find the most profitable clients using LTV marketing

LTV calculation methods

Of course, in the initial stages of using LTV, the company will have to spend more than earn. The costs associated with promoting products or services, attracting and retaining customers are inevitable. However, sooner or later, you will still have to calculate indicators on income and expenses. The firm must measure its profit, that is, the difference between income and expenses. For an individual client, this means that he must bring in more money than the company spends on serving him.

LTV - CAC = Profit

LTV stands for “customer lifetime value”, Customer lifetime value is the probable profit that an average customer of your company can bring during the entire period of cooperation. The indicator is calculated in financial terms (CLV, LCV, CLTV).

CAC - Cost per customer acquisition. The indicator is measured in dollars (aka CPA).

They calculate Customer lifetime value, first of all, in order to solve the main problem - to optimize marketing costs. You need to manage costs based on information about customer flow channels, cost marketing communications and the value of cost efficiency for all channels separately.

- 27 main formulas for calculating the main indicators of financial analysis of your company

Two formulas for calculating LTV - customer lifetime value

This is the simplest LifeTime value formula:

LTV = S × C × P × t, where

- S - average check;

- C is the average number of purchases per month;

- P - profitability as a percentage of the check amount;

- t - the average "lifetime" of the client (the number of months during which he purchases the goods).

Another formula is also used:

LTV = (S × C × P) / (1 - R).

It differs from the previous one in that the “lifetime” in this case is replaced by the percentage of consumers who left (R).

LifeTime value is calculated using a more complex method. ARPU (Avg. Revenue Per User) is multiplied by the average life expectancy (Avg. LiveTime). Service costs are subtracted from the resulting indicator for the period of its life cycle (Cost to Serve):

LTV = Average Revenue Per User x Average LifeTime of a Customer - Cost to Serve them

ARPU stands for the average income per customer over the period. Determine the period based on the life cycle of your products. If months are used to measure LifeTime, ARPU shows how much the customer will pay during the month.

It is not very clear when calculating the ALT indicator (Avg. LifeTime) - the average lifetime. When calculating, it is better to use another factor - the Churn Rate, or the percentage of customer abandonments during this period. Let's say the total number of clients is 200 people. It left 10. Therefore, the turnover was 5%. It turns out that the lifespan is a kind of unit divided by the outflow of consumers as a percentage.

Average Lifetime of a Customer = 1 / Churn Rate.

The role of this indicator is very important, because if it doubles, the customer's life cycle is also shortened by half. This means that the average profit that a given consumer brings is reduced by 2 times.

Cost to Serve includes infrastructure and support costs.

Customer Acquisition Cost is a measure of the cost of a new customer.

CAC = Total cost of Sales & Marketing / No of Deals closed.

By different estimates, LTV, for example, for newly created companies and projects should be three times more CAC (especially for SaaS).

How to optimize your LTV strategy

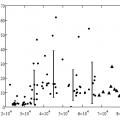

Below is a graph showing the methods of balancing the model.

Tools for reducing CAC:

- Viral effects - viral advertising.

- Inbound Marketing - engaging content and communities without ads.

- Free or freemium - the free part attracts an audience to you at a fairly low cost.

- Touthless conversion - reducing costs by reducing the degree of human participation in sales.

- Inside Sales - office sales.

- Channels - sales through partners.

- Strategic partnerships - strategic partnerships with companies with a client base.

LifeTime value growth tools:

- Recurring Revenue. The goal is to increase monthly income by increasing the base of regular customers and orders on which you earn monthly.

- Scalable Pricing is a scalable pricing model.

- Cross Sell / Upsell - if you have a large client base, you can conduct additional sales of secondary services and products.

- Product line expansion - expansion of the product line.

- Lead Gen for 3rd parties - generating leads for third parties through partner companies.

Churn Rate optimization tools:

- Loyalty assessment is possible using the Net Promoter Score tool and the question "How likely is it that you will recommend our service to others?" Read about how to use this indicator correctly in the article.

- Cohort Analysis, or cohort analysis. A cohort is a group of clients who came in within one month. The life of this group must be monitored on a monthly basis.

- The entire audience must be divided into groups, depending on their goals when using the service. Thanks to this approach, it will be possible to segment customers into categories according to the duration of their life cycle.

- Customer Satisfaction Index method.

Undoubtedly, retaining a person who already uses the services of the service is not as expensive as attracting a new one. The following guidelines will help you achieve less customer churn:

- Communicate with your audience in an open format.

- Use available channels feedback and e-mail notifications.

- Answer questions through forms and widgets on the site.

- Research your audience, study negative reviews and work with them.

- Objectively evaluate the advantages and disadvantages of your product, compare it with competitors' analogues.

- Do not use irrational solutions (new methods of work) and incomprehensible PR.

Since your product is intended for people, it is a good idea to test it with a small test group before implementation. Track the decisions your team makes and make adjustments as needed.

What is better to rely on in calculations: conversion, ROI or LTV

What are the best marketing metrics to focus on? According to some marketers, conversions need to be measured. Others think it's better to focus on ROI. Still others are sure - you should look at the LTV index.

All three metrics are important. Below we describe the features of each.

The table shows the calculation of the dynamics of the change in the cost of a conversion with an increase in the conversion itself, the calculation of the short-term ROI after the first month, the calculation of the LifeTime value, the accumulative ROI (over the entire life cycle of customers) and accumulative profit.

Note that some indicators can be diametrically opposed in different business areas. The main thing here is to analyze the possible ratios of indicators.

Conversion

The model is perhaps the simplest one. When talking about conversion, they often understand either the percentage of conversion (% conv) or its cost (CPx). By the percentage of conversion, you can track how fast a customer moves from one stage of the sales funnel to another. Based on the cost of conversion, the cost of promotion for one buyer is judged.

Pros of the conversion model

When specialists work on conversion, they try to optimize costs. As your conversion rate increases, your cost per conversion (CPx) goes down. That is, a big return with the previous investments is ensured.

Consider the information below:

- The conversion model is very easy to calculate.

- When you increase your conversion X times, you reduce its cost by the same amount. For example, with a conversion of 1%, CPx = $ 100. When the conversion doubles (from 1% to 2%), CPx is halved, that is, it will be $ 50. This is very important because you can get a lot more clients with the same budget. There are free ways to improve conversion (for example, optimizing the UX of certain website pages).

- The cost of conversion decreases at a non-linear rate, slowing down at each subsequent step. For example, when your conversion rate increases from 1% to 1.25%, your CPx drops from $ 100 to $ 80.

- The cost of optimization per consumer is $ 20. At the same time, when the conversion rises from 2% to 2.25%, CPx decreases from $ 50 to $ 44.4. The cost of optimization is $ 5.6.

With a high degree of probability, after a certain time, your CPx will freeze. To ensure that your audience continues to grow, you still need to have working capital to meet your marketing goals.

Cons of the conversion model

According to the conversion model, all conversions are the same. At the same time, it is far from the fact that when you buy customers from channels (campaigns) with a minimum CPx, you improve the quality of the customers you purchase.

Here are the basics to never forget:

Often (although not in all cases), a low CPx also means a low AMPU (Average Margin Per User). The buyer must be willing to purchase the product. If motivation is lacking, the marketer creates it. Thanks to discounts, bonuses, etc. conversion can increase significantly. But discounts and bonuses at the same time significantly reduce the company's profit from the first purchase of a client.

There is usually no direct correlation between a decrease in CPx and an increase in short-term ROI.

Above is a graph showing the decline in CPx. At the same time, short ROI decreases and increases. This is because different channels(from various campaigns) come different buyers purchasing products of different types, quality and prices.

Do not forget that about 40-60% of all customers are one-time buyers, and therefore it is better to calculate ROI after the first purchase (first month).

The conversion model can tackle the top-priority acquisition issues. At the same time, it does not take into account the buyer's life cycle at all in the further stages following the acquisition.

Let's dwell on the LifeTime value model. Its concept is quite rational. You are not focusing on costs, but on the income that the client will bring you over the long term. Surely, you have already understood that one purchase cannot be used to judge the success of investing in a channel (neither at the AMPU level, nor at the level of short-term ROI).

Pros of the LTV model

Thanks to LifeTime value, you will learn about the threshold rational value for assessing the maximum likely value of the consumer when buying it. Of course, spending more on a customer's purchase than the amount that he can bring you during his life cycle is irrational. In addition to losses, you will receive nothing in this case. In this regard, in SaaS, one of the fundamental rules is the ratio: LTV> 3 x CAC.

You are focusing on the buyer's profit, therefore, you are thinking about increasing the profitability of your company in the near future and in the future.

It is clear from the graph that buyers with a conversion rate of 2.50%, 2.75% and 3.00% as a result bring customers whose LifeTime value is two to three times lower compared to customers with a conversion of 2.25%.

Cons of the LTV model

- It's hard to calculate. The LTV model assumes the most accurate forecast of changes in three parameters - regularity and amount of repeat purchases, Gross Margin and Churn Rate. The main difficulty lies in the fact that all these components can change as long as the company exists. That is, they are not static.

- Optimization based on the LTV model does not always bring the highest resulting profit (AccProfit).

The chart shows the profits of the various cohorts. Upon examination, it becomes clear that the highest income is in the two cohorts - the cohort with the highest LTV (USD 476) and the larger cohort with only the third largest LifeTime value (USD 208).

There are always few consumers who can bring the company the most income. If you rely solely on this category, your income will one day stop growing. You will not be able to continue to find the required number of profitable clients, that is, to develop at a given speed.

In this regard, using the LTV model, you should understand that after reaching the maximum number of profitable customers, you will have to pay attention to campaigns (channels) with not the maximum LTV. But there will be more opportunities for attracting new buyers.

Many startups today prefer to use the LTV / CAC metric, as it takes into account both revenue and expenses. It is more rational to use its analogue AccROI = LTV / CAC - 1. The formula demonstrates the interchangeability of indicators. However, for a 1.50% conversion, we get AccROI = -42%, with LTV / CAC = 0.58. That is, AccROI clearly focuses on unprofitable cohorts and reduces revenues, stimulating you to be even more productive.

The ROI model can be somewhere in between conversion models and LifeTime value. However, the ROI is still closer to the LTV model. Is the ROI always taken into account and ra?

LTV (Lifetime Value) is the total profit of a company received from one client for the entire period of cooperation. Simplified version The Russian definition that characterizes this indicator is the lifetime value of the client. This metric is also called CLV (Customer Lifetime Value) or CLTV.

Why it is important to know LTV

Knowing how much money you get on average from one client for the entire time that he remains a client, you can easily understand how much money you are willing to spend on attracting one client and on marketing in general. In general, this is why LTV is considered.

Knowledge of LTV will allow:

- determine ROI per client;

- choose the most effective acquisition channels if you know how much it costs to attract one customer from each channel;

- improve strategy;

- Improve the behavioral triggers that motivated your subscriber to make their first purchase.

Why consider a customer's LTV as a subscriber

While LTV is usually calculated in relation to the time during which a customer remains a customer, then in email marketing only the time that he is a subscriber is taken into account. For example, a client came from a mailing list and bought a subscription to watch TV series online. After six months, he turned down the mailing list, but remained a client and watched the series for 2 years.

Then his LTV as a client will be calculated for 24 months, and as a subscriber - for six. The benefit of calculating subscriber LTV is to understand how justified the costs of email marketing are and optimize them (see cheat sheet):

Formula for calculating LTV

Divide your email marketing revenue by the number of customers who came from your email channel in the last year. Multiply the resulting indicator by the average time that a subscriber is in the mailing list.

Example

Annual revenue from the email channel: 3,000,000 rubles.

Costs per year for email marketing: 1,200,000 rubles.

Received clients: 1000

Average period of activity: 10 months.

We deduct the costs from the proceeds: 3,000,000 - 1,200,000 = 1,800,000 rubles.

1,800,000 / 1,000 = 1,800 rubles / month brings one client received from email marketing

1,800 * 10 months = 18,000 rubles brings 1 active subscriber for 10 months.

How to increase subscriber LTV

The more money one subscriber brings, the better for the company. When calculating LTV, pay attention to all the numbers you use in the formula. It is important not only to keep subscribers in the database as long as possible, but also to reduce the cost of email marketing. For example, if you have a fancy mailing system, and you use only the simplest functions, it may be worth switching to a simpler mailer; if your database has a lot of inactive subscribers, you need to reactivate them and clean the database.

It turns out that subscriber LTV is an indicator of the health of your email marketing. It reflects both the feasibility of costs, and the involvement of subscribers in interacting with the company, and the benefits of email marketing in terms of per user.

Many companies analyze customer lifetime value (CLV) to determine the financial benefit (value) of a relationship with a specific customer. Let's consider the features of the analysis of this indicator using an interactive form for the calculation.

Figuring out which clients to invest time and money in is critical if you want to maximize your bottom line.

Many companies analyze an indicator called customer lifetime value (CLV) to determine the value of a particular customer in comparison to other customers.

Even if you don’t have to calculate CLV yourself (there are now many tools that will do all the math for you), it’s important for you to understand the concept of this metric so that you can decide whether to use it in your marketing and management decisions.

What is CLV?

Here's the basic definition:

The amount of profit that your company can earn on this client, while this person (or company) remains a client (for example, n-th number of years).

At its core, CLV is the present value of all future streams of profit that given client generates during the entire period of his relationship (as a client) with the company.

This is a very useful indicator.

By comparing CLVs by customer, you can determine which ones are more or less beneficial to you. So you can segment your customer base.

Understanding each customer's ROI is the first step to managing your customer base. Then you can decide where to focus your marketing, product development, acquisition and customer retention efforts.

The mathematical underpinnings of CLV are complex — not easy to do on the knee.

CLF Formula:

- CR = customer revenue,

- C = direct marketing costs per customer,

- R = customer retention rate,

- d = discount rate,

- AC = Customer Acquisition Rate.

The interactive form below allows you to make an automatic calculation and understand how the various elements of the formula affect the final result.

Note: There are several ways to calculate CLV. This interactive illustration shows you one of them.

To use the interactive form, adjust the sliders on the left side to see how each factor affects CLV over five years and the expected contribution to coverage (English "contribution margin") according to the client for each year.

Example of customer lifetime value analysis.

Now, imagine you have a typography and you would like to find out which category of your customers is most valuable to you:

- small firms who use the services almost regularly or

- large companies who place orders only a few times a year, but for significant amounts.

Let's start by figuring out the CLV for the first group.

On average, these small customers purchase from you 10 times a year and spend $ 200 on each order. Install average number of purchases per year at 10 and average spend per purchase at $ 200.

Average gross margin for these orders is 41% (set the slider accordingly).

Now the question is how much do you spend on marketing and how effective are your efforts?

Your total marketing budget is $ 10,000 per year and you have a total of 500 clients, so your direct marketing costs per customer per year are $ 20.

You've been making calls and mailings to local businesses to acquire new customers, and you find that for every 100 mailings you send, you get 2 new customers. Thus, set the slider customer acquisition rate (English "Acquisition response rate") in 2%.

You have done a good job of keeping clients over the years, so your customer retention rate accounts for 80% for this category of clients (small firms). Set the corresponding value with the slider.

The last thing you need to define is your discount rate (English "Average discount rate").

When calculating CLV, you determine the average annual profit from a customer over a specified number of years. But the profit you make in the future is less valuable than the profit you make today.

Discount rate in the CLV equation is needed to calculate the present value of this future profit and corresponds to the present value of money. Different companies may use different rates, but let's say you predict a 10% rate will be the most accurate.

You can see that for this customer category, the CLV is $ 699 for a five-year term.

To compare this result with another category - your high-profile customers, change the parameters as follows:

Large companies place an order about 3 times a year.

- But they spend almost twice as much on an order, so set your average spend per purchase to $ 400.

- The gross profit (eng. "Average gross margin") is slightly higher: 50%.

- Your mailings and calls are more effective for this category of clients. The customer acquisition rate ("Acquisition response rate") is 4%.

- Direct marketing costs per customer per year, the "Average discount rate" and the "Average customer retention rate" remain unchanged ...

CLV is now $ 732, which is slightly better.

This may mean that you should spend more resources on larger clients. Perhaps you should develop loyalty programs for these customers or make other efforts to retain them.

Most importantly, by using this model for analysis, you can see how different factors will affect CLV.

For example, what happens when the average annual number of orders increases, marketing costs decrease, or the customer acquisition rate increases.

Customer Lifetime Value (LTV) is the total income that a customer brings over the period of cooperation with the company.

Its correct calculation will help determine how much your customers spend money, how often they spend it, as well as what programs and bonuses they are interested in and can make them regular customers.

Why is LTV so important? In Internet businesses, the term Return On Investment (ROI) is often used. ROI is the percentage of the earned profit in relation to the investment made. Taking customer lifetime value into account when calculating ROI will help you see the complete picture of your business profitability and how it can be managed. We will definitely tell you more about ROI, but for now let's return to the customer's lifetime value.

How to calculate customer lifetime value?

There are several ways that we can use to calculate LTV. Let's start with a basic formula:

Average order value X Number of sales X Loyalty period

For example, take the hot subscription service Birchbox, which costs $ 10 for women and $ 12 for men.

$ 10 X 12 months X 3 years = $ 360

Using Birchbox as an example, a female subscriber brings the company $ 120 per year. If the client stays with them for 3 years, then the lifetime value is $ 360.

FormulaLTV no periodic subscriptions

So, our calculations were simple so far. Consider an example where we need to calculate the LTV of customers who do not pay the same monthly payment.

Take, for example, an online home health store. Let's select three separate buyers to calculate the average sales:

- Client A takes care of his diabetic grandmother. Every month he buys syringes and test strips, sometimes a blood glucose meter. His monthly purchases are $ 60.

- Customer B buys diabetes tests every month and her average order is $ 25.

- Client C buys medications for several members of his family. Every month she buys test strips, syringes, insulin pumps, special containers and socks for diabetics. Her monthly purchase costs average $ 150.

Let's calculate the monthly sales for these three buyers:

We add up the monthly receipt of each customer and divide the received amount of $ 235 by their number. Average monthly revenue is $ 78

We add up the monthly receipt of each customer and divide the received amount of $ 235 by their number. Average monthly revenue is $ 78

$ 78 x 12 months x 5 years = $ 4680

According to this formula, the customer lifetime value is $ 4680 for the entire period or $ 936 for the year.

Why you need to knowLTV

Having realized the importance of the information received for your business, having spent a few hours on all the calculations, you will be able to determine which customers are most valuable to you, how to distinguish them, what affects the loyalty of your customers and what methods you can use to increase LTV.

Customer Lifetime Value is, simply put, how long a customer will be associated with your product. But not all clients can be equally useful to a business. There are many "sleeping" buyers on the market, and the most active consumers may prefer yours. Such multidirectional interests constitute the target one, for which one has to fight.

The target market must be specific

One of the important principles of marketing management is building an effective marketing strategy based on targeting and positioning. The first step is to classify your customer base. Otherwise, all of your customers can be considered just a population, which consists of various groups that are not differentiated among themselves. Organization of sales in such a situation is a big risk of wasting your time and money. Basically, the business is unambiguously confused about what the right marketing strategy to use and how to sell it most effectively.

The target market must be valuable

Customer segmentation is aimed at identifying the most attractive customers who are able to regularly buy your services. Good marketing starts with the most attractive segment, which can be addressed with a clear and understandable advertising message.

Targeting (targeting) is the next step to success. It is necessary to effectively attract customers from the selected segment. Customer preferences drive strategy. If you are targeting the youth segment, then your products should be more creative, more colorful and cheaper. Your advertising messages must be bright. But if you are targeting average age, your product should be elegant. This is natural because consumers have a lot of purchasing power. And your promotions should focus on the unique benefits of the service. Thus, a targeting strategy will optimize advertising costs.

When you have your segment and you know who to target, you embark on the subtle art of positioning. The bottom line is to distance yourself from direct competitors according to criteria that are significant for customers. If targeting mainly affects the marketing stage "Product and pricing", then positioning affects the stage of promotion and elements of the marketing mix.

When targeting, you need to tailor according to your target segment. Positioning requires making sure that the right ad message is conveyed to your target segment and that the in-demand products are offered at the right time.

New customers or regular customers?

By analyzing the current market situation, you will try to find to expand your sales market. You will begin to attract new customers and involve them in your area of interest. Advertising costs may vary. This is due to varying degrees of awareness of potential buyers about your offer to the market. In addition, some new clients will be more demanding and will compare the company's services with their accumulated experience. More persuasiveness will be required for these buyers.

It is a well-known fact that a company spends more money on attracting new customers rather than retaining regular customers. Thus, calculating the cost of living of a client helps to understand exactly what level of income is generated from each client. In addition, systematic cost analysis provides insight into the difference between the average cost of acquiring new customers and retaining old customers in order to identify ways to maximize sales profit.

What is Lifetime Value (LTV)

First of all, this is the expected profit that the business will be able to receive from sales from each regular customer in the future. Although the calculations are based on the past history of the customer relationship, the Lifetime Value is information about the future. The customer base KPI is based primarily on the expected customer retention rate and the costs associated with this process.

The feasibility of retaining customers is highly dependent on the value of the lifetime value. In fact, the customer's cost of living (CLV) or customer lifetime value (LTV) is the net present value of the cash flows associated with customer relationships. Application of this key indicator as a marketing metric forces the business to focus more on customer service and long-term customer satisfaction rather than maximizing short-term sales.

How to calculate LTV?

To understand LTV, I suggest using a typical table for calculating lifetime value (all data is fictitious).

Let's say you built a customer base of 1,500 in your first year. Subsequently, you collected statistics about your regular customers, and noticed that in the first year, 40% of buyers did not make repeat purchases. Naturally, you need to build up your customer base, cover your target market with original advertising in order to attract new customers. Every year, the whole process of fighting for a client will continue, but someone will never return to you.

Obviously, the loyalty of retained repeat customers is higher than that of newly reached ones. As customers stay with you, their number of orders per year and their average order size tend to increase.

The cost of servicing returning customers is usually lower than the cost of new customers. It takes less effort for a company to prove a superior product. Taking this fact into account, you will be able to optimize marketing costs, which will allow you to increase the profit of your business without loss.

Business invests for future profit

The company's profit is simple: income minus expenses. But the value of money changes from year to year due to inflation. Additional funding may be required to create a loyalty program. Therefore, it is necessary to divide the resulting profit by the discount rate in order to calculate the net present value of the expected profit. The discount rate (based on bank interest rates) is necessary because future profits are not worth as much in today's money as the company's calculated profits.

This postulate is based on the concept of time value of money. The money that a business can invest in building long-term customer relationships should be profitable, but its value changes over time. An investor can receive additional income from alternative investment options for every 100 rubles per year. For example, he can simply put them in the bank for a deposit and return them without risk with interest. Consequently, in a year, each investment ruble will be of great value to the investor. Determining the value of future income at the moment is called discounting. In this case, the discount rate is the rate of return on invested capital required by the investor.

In this example, you yourself become an investor, and you take the missing investment from the bank as a loan. The discount rate will take into account the percentage of the deposit and the cost of borrowed funds.

After discounting the company's profits for the second and third years, you can calculate the accumulated net profit of the company obtained through the implementation of a customer retention program. If we calculate the lifetime value of customers without discounting (just add up the company's profit for three years and divide by the number of customers in the first year), our calculations will not include the company's profitability (for a business owner this is a significant moment), despite the fact that it directly affects the definition the effectiveness of investments in attracting new customers.

The result of all calculations makes it possible to determine not only future income from regular customers, but the dynamics of their changes. The Customer Lifetime Value Calculation table can be used to assess the expected results of new marketing programs before you spend significant money on them.

Summary

Advantage systems approach to customer retention based on lifetime value calculations forces us to view loyalty program costs as an asset that can generate income rather than an onerous obligation.

The LTV calculation reveals the balance between the cost of attracting new customers and the company's profit while retaining regular customers.