Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Posted on http://www.allbest.ru/

Federal State Budgetary educational institution higher professional education

Russian Academy of National Economy and public service under the President Russian Federation

"NORTH-WESTERN INSTITUTE"

Department of World and National Economy

Course work

Forms of international settlements: comparative characteristics and practice of application

3rd year student 3264 groups

Kazmina Yuri Alexandrovich

scientific adviser

PhD in Economics, Associate Professor

Khodachek Galina Mikhailovna

Saint Petersburg

- Introduction

- 1.4 Bank Transfer

- Conclusion

Introduction

Since the liberalization of foreign economic activity, increased attention has been paid to the organization and management of foreign trade operations, both at a theoretical and practical level. In connection with the global trends in the unification of the methodological base of international trade, the strengthening of integration processes, the emergence of new forms and methods of trade, the legislative base in this area of economic activity is dynamically developing.

Foreign trade is the most developed form of international economic relations... A feature of the world market at present is the development of interstate forms of its regulation: common trade organizations (GATT / WTO), regional integration associations (EU, Association of Southeast Asian countries, etc.). The result was an increase in the scale and qualitative changes in the nature of international trade, which has a tremendous impact on the internationalization of the economic life of all countries of the world.

Development international relations and, first of all, trade, provokes a constant search for settlement methods that minimize the risks of both parties involved in civil law relations. The buyer wants to be sure that the goods will be shipped (in accordance with the terms of the contract), the seller - that the goods will be paid for in the manner prescribed by the foreign economic agreement.

Relevance of the topic term paper due to the fact that when concluding a foreign trade transaction, the choice of the optimal forms and methods of payment for the supplied goods is one of the key - the speed and guarantee of payment depends on the correct choice by the counterparties of the form and banking and financial operations, as well as the ability to prevent claims and resulting losses.

The purpose of the work is to study the basic forms of settlements used in the practice of payment for the supplied goods under foreign trade transactions.

Work tasks:

1. To study the essence, purpose, legal support and scheme of application of the main forms of international settlements.

2. Determine the direction of comparative characteristics of settlement forms to justify the choice of a particular form of settlement, stipulated in a foreign trade contract.

Despite the dominant position of documentary settlements over other banking operations, this topic has not been sufficiently studied at present. There is no comprehensive approach to solving the problem, there is no consensus in the assessment of certain forms of international settlements and payment conditions of foreign trade transactions.

international settlement form letter of credit

Chapter 1. Payment for foreign trade transactions: forms and practice of application

1.1 The concept of international settlements

Foreign trade is the most developed form of foreign economic activity. The essence foreign trade consists in the exchange of goods and services between business entities different countries(export-import operations), based on the internationalization and globalization of world economic relations, the intensification of the international division of labor in the context of the scientific, technical and information revolution.

Payments in foreign trade are carried out using international settlements. International settlements is a system for organizing payments for monetary claims and obligations arising from the implementation of foreign economic activity between states, enterprises (organizations) and citizens located on the territory of different countries.

The subjects of international settlements, interacting with each other in the process of movement of documents of title, are exporters, importers, banks. Banks organizing the movement Money participants in foreign trade activities, act as intermediaries.

The procedure for making settlements for exported and imported goods (services) is regulated by the legislation of the countries, and also obeys international rules documentary registration and payment of payment documents.

The development of international relations, and, first of all, trade, provokes a constant search for settlement methods that minimize the risks of both parties involved in civil law relations. The buyer wants to be sure that the goods will be shipped (according to the terms of the contract), the seller wants to be sure that the goods will be paid for in the manner stipulated in the foreign economic agreement.

1.2 Characteristics and types of settlements under the letter of credit

Letter of credit is an order from the buyer's bank (issuing bank) to the supplier's bank to pay the supplier for goods and services on the terms stipulated in the buyer's letter of credit against the relevant documents submitted by the supplier confirming the delivery of the goods in accordance with the contract.

A feature of the letter of credit is its strictly formal nature. This means that all interested parties involved in operations under a letter of credit deal with documents, and not with goods, services and / or other types of performance of obligations, to which the documents may relate.

Settlements under a letter of credit are one of the most frequently used forms of payment for goods (works, services) in foreign economic contracts. When making settlements under a letter of credit, a bank acting on behalf of the payer and in accordance with his instructions (issuing bank) undertakes to make payments to the recipient of funds or to pay, accept or register a bill of exchange.

Calculations by letters of credit are carried out in accordance with the scheme shown in Fig. one . The exporter and the importer enter into a contract (1), in which they indicate that payments for the delivered goods will be made in the form of a documentary credit. The order of payment must be specified in the contract, i.e. the terms of the future letter of credit are clearly and fully formulated. The contract also specifies the bank in which the letter of credit will be opened, the type of the letter of credit, the name of the advising and executing bank, the terms of payment execution, the list of documents against which the payment will be made, the terms of the letter of credit, the procedure for payment of the bank commission, etc. Terms of payment contained in contract, must be contained in the order of the importer to the bank to open a letter of credit.

Rice. 1. Scheme of settlements by letters of credit

After the conclusion of the contract, the exporter prepares the goods for shipment, and notifies the importer of this (2). After receiving the exporter's notification, the buyer sends his bank an application for opening a letter of credit, which specifies the terms of payment contained in the contract (3). After the opening of the letter of credit, the issuing bank sends the letter of credit to the foreign bank, as a rule, to the bank serving the exporter (4) - the advising bank. The advising bank, having verified the authenticity of the received letter of credit, notifies the exporter of the opening and conditions of the letter of credit (5).

The exporter checks the compliance of the terms of the letter of credit with the payment terms of the concluded contract. In case of non-compliance, the exporter shall notify the advising bank of the non-acceptance of the terms of the letter of credit and the requirement to amend them. If the exporter accepts the terms of the letter of credit opened in his favor, he will ship the goods within the terms established by the contract (6). Having received transport documents from the transport organization (7), the exporter submits them, along with other documents provided for by the terms of the letter of credit, to his bank (8).

The bank checks whether the submitted documents comply with the terms of the letter of credit, the completeness of the documents, the correctness of their preparation and execution, the consistency of the details contained in them. After checking the documents, the exporter's bank sends them to the exporting bank (9) for payment or acceptance. V cover letter the procedure for crediting the proceeds to the exporter is indicated.

After receiving the documents, the issuing bank carefully checks them, and then transfers the payment amount to the bank serving the exporter (10). The importer's account is debited for the payment amount (11). The exporter's bank credits the proceeds to the exporter's account (12). The importer, having received commercial documents from the issuing bank (13), takes possession of the goods.

From a practical point of view, all letters of credit are divided into two large groups:

cash letters of credit

trade letters of credit.

A money letter of credit is a registered document issued by a bank to a person who has deposited a certain amount to receive it in another bank, city or country within a certain period. Commodity letter of credit is an order of the bank serving the buyer, the supplier's bank to pay the supplier's invoices for the shipped inventory items on the terms provided by the buyer and specified in the letter of credit.

In addition, letters of credit are divided into:

revocable and irrevocable letters of credit;

confirmed and unconfirmed letters of credit.

A revocable letter of credit is a letter of credit that can be canceled both by the bank that opened it and by the buyer during the validity period of the letter of credit. An irrevocable letter of credit is a letter of credit that cannot be canceled during its validity period without the consent of the supplier. The confirmed letter of credit contains confirmation from a first-class bank, which is equivalent to an additional guarantee of payment to the supplier of the shipped goods. An unconfirmed letter of credit does not contain guarantees from a first-class bank.

International practice uses such types of letters of credit as transferable (transferable), reserve, renewable (revolving), early opening, letters of credit with a "red clause", countervailing letters of credit and priority letters of credit, etc.

A transferable (transferable) letter of credit is increasingly used in international practice. It allows you to make payments from it not only in favor of the beneficiary, but also third parties - the second beneficiaries. Transfer of a letter of credit in favor of third parties is made at the request of the beneficiary in whole or in part. A transferable letter of credit is usually used if the beneficiary is not the supplier of the goods or the delivery is made through an intermediary.

The second beneficiary, having shipped the goods to the importer's address, submits commercial documents to the bank that meet the terms of the letter of credit in order to receive payment. The beneficiary, in favor of whom the transferable letter of credit was opened, was granted the right to replace the accounts (and drafts) provided by the second beneficiary with his own accounts (and drafts) and receive a possible difference between the amounts of these accounts.

If the terms of the letter of credit do not provide for the possibility of its transfer, and the beneficiary under the letter of credit is not the supplier of the goods, a compensatory letter of credit may be used in the calculations. It is opened by the beneficiary under the main, basic letter of credit as a counter letter of credit in favor of the manufacturer of the goods or subsupplier. Basic and back-to-back letters of credit are independent and legally not related. When opening a compensation letter of credit, it is necessary that the conditions of the compensation letter of credit comply with the conditions provided for by the basic letter of credit. This concerns, first of all, the terms of delivery of the goods and the requirements for the submitted documents. If the terms of the base and back-to-back letters of credit are the same and the same documents must be submitted to receive payment under the letter of credit, then the documents submitted by the supplier under the back-up letter of credit can be used to pay under the base letter of credit. If the conditions of the basic and compensatory letters of credit do not match, the seller must supplement the set of documents received from the supplier during the implementation of the compensating letter of credit.

In order to secure payment under the back-to-back letter of credit, it must have a validity period beyond the validity period of the underlying letter of credit.

When delivering goods in equal lots, a revolving (renewable) letter of credit may be used in the calculations. A revolving letter of credit provides for the replenishment of the letter of credit by a certain amount (quota) or to the original value as it is used. When opening a revolving letter of credit, as a rule, the total amount of the letter of credit, the size of one quota and the number of quotas, as well as the period of use of the quota are indicated.

To secure payment under a letter of credit, a letter of credit with foreign exchange coverage may be opened. When opening covered letters of credit, the issuing bank provides the foreign bank performing the letter of credit with foreign currency in the amount of the letter of credit to be opened for the period of its validity, subject to the use of these funds for payments under the letter of credit.

The provision of foreign exchange coverage when opening a letter of credit leads to the freezing of funds of the issuing bank for the period of its validity. Therefore, in international practice, uncovered letters of credit are mainly used, which do not require the diversion of funds from the issuing bank at the time of opening a letter of credit.

In international practice, a "red clause" letter of credit is sometimes used, which provides for the issuance of advances by the executing bank to the exporter up to a certain amount. The advance is usually used by the beneficiary to purchase a product for export. In fact, part of the amount of the letter of credit is used to pay for the unshipped goods. Banks issue advances against the exporter's submission of a “shipment obligation” or other similar document. By opening a letter of credit "with a red clause", the issuing bank undertakes to reimburse the performing bank for the amounts of advances paid, even if the shipment of the goods under this letter of credit was not made.

As a way of fulfilling contractual obligations in international practice, a reserve (guarantee) letter of credit is used, according to which the seller does not need to submit documents for the goods to the bank - the opener of the letter of credit if the buyer pays for the goods within the agreed period. Such a letter of credit is paid by the opening bank only if the buyer has not made the payment on time. Essentially, this type of letter of credit is warranty obligation... The advantage of a guarantee letter of credit is that it is "reusable", i.e. it can be used when purchasing multiple lots.

The procedure for settlements under a letter of credit in the legislation of the Russian Federation is currently determined by the Civil Code of the Russian Federation (Chapter 46 § 3 "Settlements under a letter of credit"). In the field of foreign trade, settlements under letters of credit are also carried out in accordance with the instruction of Vneshtorgbank of the USSR No. 1 dated December 25, 1985 on the procedure for performing banking operations on international settlements.

V international trade developed and widely used Uniform Rules and Practices for Documentary Credit (2007 revision), publication of the International Chamber of Commerce No. 600 (UCP-600), which are the result of many years of efforts to systematize international trade and banking practices. These Rules represent a private (unofficial) codification and, to a certain extent, the unification of the customs of business practice that have developed in practice.

1.3 Collection form of settlements

One of the most balanced forms of settlement, both for the buyer and for the supplier, is collection settlement. Collection is an order of the exporter to his bank to receive from the importer (directly or through another bank) a certain amount or confirmation (acceptance) that this amount will be paid in due time. Collection is used in settlements both under the terms of payment in cash and with the use of a commercial loan.

When dealing with collection operations, banks and their clients are guided by the Unified Collection Rules - the main international normative document governing this form of settlement.

The unified rules determine the types of collection, the procedure for submitting documents for payment and making a payment, acceptance, the procedure for notification of payment, acceptance or non-payment (non-acceptance), determine the obligations and responsibilities of the parties, give a uniform interpretation of various terms and resolve other issues.

According to the Unified Rules, collection is an operation carried out by banks on the basis of instructions received with documents in order to:

receiving acceptance and / or payment;

issuance of commercial documents against acceptance and / or payment;

issuance of documents on other terms.

Depending on the types of documents with which the collection operation is performed, there are two types of collection:

net collection, i.e. collection of financial documents, which include checks, bills of exchange, payment receipts and other documents used to receive payment in cash;

documentary collection, i.e. collection of commercial documents, which may or may not be accompanied by financial documents.

The participants in the collection operation are:

principal - a client who entrusts a collection operation to his bank;

remitting bank - a bank to which the principal entrusts a collection operation;

collecting bank - any bank, which is not a remitting bank, participating in an operation to execute a collection order;

presenting bank - a bank directly receiving payment or acceptance, submitting documents to the payer;

payer - a person to whom documents must be submitted in accordance with a collection order.

Settlements in the form of collection are constructed as follows (Fig. 2): after the conclusion of the contract (1), in which the parties agree through which banks, in accordance with the terms of the concluded contract, settlements will be made, the exporter ships the goods (2). Having received transport documents from the transport organization (3), the exporter prepares a set of documents, which includes commercial and, possibly, financial documents, and submits it to his bank (remitting bank) with a collection order (4). Having received the documents from the principal, the remitting bank checks them according to their external features, which are indicated in the collection order, and then acts in accordance with the instructions of the principal contained in this order and the Unified Rules.

Rice. 2. Scheme of payments for collection

The remitting bank submits the documents to the collecting bank (5), which is, as a rule, the bank of the importing country (5), which presents them to its client. In case of acceptance (7), the importer's bank transfers the money (8) sends the documents. The remitting bank makes a corresponding statement to its client.

Comparing the provisions of the Unified Rules with the provisions of Russian regulations, we can conclude that net collection is represented in our legislation by payment requests and collection orders, and documentary collection (financial documents accompanied by commercial documents) is carried out on the basis of a payment request-order issued to the payer's invoice.

Unfortunately, in banking practice, collection orders are often issued instead of payment orders, payment orders instead of payment orders-orders, etc. This confusion could have been avoided if the legislator had established a clear and uniform procedure for payments for collection, which would be carried out by the obligatory submission of a collection order in addition to the rest (in each case different) documents.

Summing up, it should be noted that when carrying out foreign economic settlements using collection, one should be guided by the provisions of the Rules, and it is also necessary that the party to the transaction, which is aware of the existence of any peremptory norms in its national law, notifies the other parties about it. Therefore, when concluding an agreement for the provision of goods, services, etc. the parties must agree not only on the form of non-cash payments, but also the restrictions that exist for this form in the national legislation of the payer's country.

1.4 Bank Transfer

A bank transfer is a simple order of the bank to its correspondent bank, to pay a certain amount of money at the request and at the expense of the originator to the foreign recipient (beneficiary), indicating the method of reimbursing the paid amount to the paying bank. A bank transfer is carried out by means of payment orders addressed by one bank to another, as well as (if there is a special interbank agreement) by bank checks or other payment documents.

Commercial or shipping documents are sent in this form of payment from the exporter to the importer directly, i.e. bypassing the bank.

The scheme of settlements by bank transfers is shown in Fig. 3.

Rice. 3. Scheme of settlements by bank transfers

After the conclusion of the contract (1) between the importer and the exporter, the importer sends an application for transfer to the bank (2). Delivery of goods may precede or follow payment, which is determined by the terms of the contract and the currency laws of the countries. The importer's bank, having accepted the payment order from the importer, sends on its own behalf the payment order (3) to the corresponding exporter's bank. Having received the payment order, the bank verifies its authenticity and makes an operation to credit money (4) to the exporter's account.

The procedure for making settlements by payment orders is regulated by the Civil Code, the Laws on the Central Bank of Russia, on banks and other laws of the Russian Federation, as well as the Regulation on cashless payments developed in accordance with these laws, which regulates the implementation of cashless payments between legal entities in the forms, provided by law, determines the formats, the procedure for filling out and processing the settlement documents used, and also establishes the rules for conducting settlement transactions on correspondent accounts (sub-accounts) of credit institutions (branches), including those opened with the Central Bank of Russia, and accounts of interbranch settlements. The provision on non-cash payments does not apply to the procedure for making non-cash payments with the participation of individuals.

1.1. Other ways of organizing international settlements

Payment for foreign trade transactions can also be carried out using such methods of organizing international settlements as:

1. Calculations for open account.

2. Calculations in the form of an advance.

3. Currency clearing.

4. Bill of exchange settlement.

5. Check form of payments.

When making settlements on an open account, the seller ships the goods to the buyer and sends documents of title to him, referring the amount of debt to the debit of the account opened by him in the name of the buyer, makes periodic payments to the exporter after receiving the goods. The latter pays off the debt in parts - at intervals stipulated by the contract or after a certain period after the shipment of individual consignments of goods.

After settlement is complete, final reconciliation and settlement of the outstanding debt are made.

Clearing is the netting of payments, i.e. a situation when monetary claims (accounts receivable) of participants are paid off by their own monetary obligations (accounts payable) without using real money.

Clearing operations are usually classified according to two criteria: frequency of performance and composition of participants. According to the first criterion, clearing is subdivided into one-time, which is carried out occasionally as the accounts receivable and payable accumulate, or permanent, which is carried out periodically, regardless of the state of monetary obligations and monetary claims of the clearing members. Clearing can be two - or multilateral, depending on the composition of the participants.

Foreign exchange clearing represents intergovernmental agreements on mutual (non-cash) offset of international claims and obligations based on an agreement between the governments of two or more countries. Currency clearing assumes the centralization of settlements between the states - parties to the clearing agreement on special clearing accounts opened by authorized banks. This circuit wears binding character for individuals and legal entities whose transactions are subject to the agreement. Importers and exporters, as well as other lenders and borrowers, are not entitled to make mutual settlements other than currency clearing. Foreign exchange clearing is also based on other mandatory elements:

its volume;

clearing currency;

the size of the technical loan

Clearing volume refers to the extent to which payments are covered. With full currency clearing, the entire foreign trade turnover falls under this scheme. In case of partial clearing, non-trading operations (tourism, maintenance of embassies and trade missions, foreign business trips, etc.) are carried out in the usual way - through correspondent accounts.

The clearing currency is the agreed unit of account (currency) in which clearing accounts are maintained. It can be expressed in currency: one of the partner countries; both states or a third country.

Payments or receipts from clearing accounts are made in each country only in terms of national currency at the appropriate rate. Clearing currencies are used exclusively in a non-cash form. The source of clearing currencies is mutual lending for the supply of goods and the provision of services by the countries participating in the agreements. Clearing currencies are used according to the principle: they must be spent in the country where they were earned.

The amount of technical credit (the maximum allowable balance of debt) is necessary to ensure the continuity of settlements; is determined in accordance with the share of the debt balance in the volume of supplies. In practice, applied different ways regulation of the balance of the clearing account.

In international transactions, the bill form of settlement is actively used. In accordance with the bill of exchange, formalized by the 1930 Geneva Convention on Bills of Exchange and Promissory Notes, a bill is "an unconditional monetary obligation of one party to the other. A bill of exchange is a means of formalizing a credit provided in a commodity form to a buyer in the form of a deferred payment." From the definition presented, it follows that calculations in this form accompany commercial lending.

From the point of view of the interaction of legal entities and participation in this form of settlement of banks, it is necessary that the importer's bank be a domicile (i.e., the payer), and the exporter's bank has an instruction from the exporter-holder of a bill to collect (i.e., an instruction to receive) payment for promissory note.

In this particular case, the bill of exchange will look like this (Fig. 4).

Rice. 4. Bill settlement scheme

The importer concludes with his bank an agreement-order for the domiciliation of bills of exchange (1), i.e. to ensure payments for them. After receiving the goods (2), the importer issues a bill of exchange (3) to the exporter, which indicates the date of payment for the goods. The exporter transfers this bill of exchange to his bank for collection (4). The exporter's bank notifies the importer's bank with a subpoena that he has a bill of exchange (5). If there is an amount on the account of the importer, the servicing bank can immediately transfer the money to the account of the exporter (6). After that, the exporter's bank notifies its client about crediting to his account the amount of payment on the bill of exchange (7) and returns the latter to the importer's bank (8). The importer's bank sends its client a bill of exchange with a statement of the end of the operation on it (9).

If there is no money on the current account of the importer, and the due date for payment of the bill of exchange comes, then the importer's bank is not responsible for non-payment, unless there is a special agreement on a loan in payment of the bill of exchange between him and the client.

In case of delay, the exporter's bank presents the unpaid bill of exchange to the notary's office (10) for making a protest (11). Then the unpaid bill of exchange with a protest is returned to the exporter for a decision (12).

In international settlements, a check form is also used. A check is a security containing an unconditional order (order) of the drawer to the paying bank to make payment of the amount indicated in it to the check holder (bearer) or, by their order, to other persons (order check) at the expense of the drawer of funds available to the bank.

In practice, the following procedure for paying a check is applied:

the check is paid at the expense of the drawer;

is payable on condition that it is presented for payment within the time period established by law;

the payer is obliged to verify the authenticity of the check, as well as that the bearer of the check is an authorized person for it (when paying for an endorsed check, the payer is obliged to check the correctness of the endorsements, but not the signatures of the endorsers);

the person who paid the check has the right to demand that the check be handed over to him with a receipt for payment;

payment on a check can be guaranteed in whole or in part by means of an aval (the avalist is responsible in the same way as the one for whom he gave the aval);

Submission of a check to the bank for collection in order to receive payment is considered to be the presentation of the check for payment.

The legislation also stipulates the consequences of non-payment of a check (Article 885 of the Civil Code):

if the payer refuses to pay the check, the check holder has the right, at his choice, to bring a claim against one, several or all persons obligated by the check (drawer, avalists, endorsers) who are jointly and severally liable to him;

the check holder has the right to demand from the specified persons the payment of the amount of the check, their costs of receiving payment, as well as interest;

the claim of the check holder against the specified persons may be brought within six months from the date of the expiry of the term for presenting the check for payment.

A simplified scheme of settlements by checks is shown in Fig. 5 .

Rice. 5. Check settlement scheme

The importer submits to his servicing bank a payment order for the deposit (reservation) of a certain amount on the deposit account (1) and at the same time provides an application for issuing him a check (2). Based on these documents, the buyer's bank opens a deposit for its client (3). After opening a deposit, the bank issues a check (4).

After the shipment of products or the provision of services by the exporter (5), the importer pays for them by check (6). The exporter, within a certain period from the date of receipt of the check, provides it to his bank (7). He, in turn, forwards the check to the importer's bank (8). The importer's bank transfers money (9). After that, bank statements are made to their clients (10) and (11).

So, the form of settlement represents the methods of registration, transfer and payment of shipping and payment documents that have developed in international commercial and banking practice.

The main forms of international settlements include:

1. Bank transfer.

2. Letter of credit.

3. Collection.

4. Settlements for an open account.

5. Calculations in the form of an advance.

6. Currency clearing.

7. Bill form of settlement.

8. Check form of payments.

Chapter 2. Comparison of forms of international payments

In the practice of international trade, the form of payment for delivered products, work or services performed is of great importance. Taking into account the mutual interests of participants in foreign economic transactions, settlements are carried out in various forms - in the form of advance payments, by way of collection or acceptance of a bill of exchange, checks, using a letter of credit, etc.

These forms of international settlements are used for payments, both in cash and on credit. At the same time, bank transfers are used in settlements for cash, documentary letters of credit, as well as in settlements using a commercial loan.

The choice of a specific form of settlement, in which payments will be made under a foreign trade contract, is negotiated in a foreign trade transaction and is determined by a number of factors.

Application... A letter of credit is used if the buyer and seller of the goods are distant from each other or need a reliable intermediary to complete the transaction, since they have little experience of cooperation. In such a situation, the letter of credit provides contractors with flexible payment terms; legal reliability; obtaining short-term loans.

For settlements under a letter of credit, it is characteristic that the withdrawal of money from the payer's account occurs in parallel with the sending of goods to his address. This distinguishes the letter of credit from other forms of payment, in particular from collection payments. Payments are made by the bank of the payer (recipient of the goods) in accordance with his order and at the expense of his funds or the loan received by him against the documents named in the letter of credit and subject to other conditions of the order, which the bank notifies the party authorized to receive the payment. At the same time, the money on the letter of credit continues to belong to the recipient of the goods and is withdrawn from the letter of credit only after the seller sends the specified goods and submits the relevant documents to the bank.

Collection is rarely used on the territory of the Russian Federation, not to mention the use in settlements with foreign partners. Ignoring the obvious advantages of collection settlements occurs mainly due to the confusion and imperfection of domestic legislation governing these relations, as well as the low legal culture of Russian entrepreneurs in the field of both international and Russian legislation. Often, problems in choosing the forms of payment between Russian entrepreneurs and their foreign partners arise from elementary ignorance of the regulatory framework.

Settlements by payment orders (bank transfer) is the most frequently used form of settlement in property turnover. In some legal relationships, the use of this form of payment has a priority. For example, in relations for the supply of goods, the buyer pays for the supplied goods in compliance with the procedure and form of settlements stipulated by the supply contract. If by agreement of the parties the procedure and forms of settlements are not determined, then settlements are made by payment orders.

In international trade, an open account is used for settlements between permanent counterparties, with government organizations and for commission sale of goods in the form of consignment or for multiple deliveries of a similar product, especially in small lots.

When comparing international forms of payment, an important role is played by risks exporters and importers... The interests of exporters and importers of goods and services do not coincide: the exporter seeks to receive payments from the importer as soon as possible, while the latter seeks to defer payment until the final sale of the goods. Therefore, the chosen form of settlement is a compromise, which takes into account the economic positions of counterparties, the degree of trust in each other, the economic situation, the political situation, etc.

The use of a letter of credit in the calculations is most beneficial for the exporter, who receives an unconditional guarantee of payment before the start of shipment of the goods. At the same time, the receipt of payment under the letter of credit (provided that the exporter fulfills the conditions of the letter of credit and submits the documents specified in it to the bank) is not associated with the buyer's consent to payment.

However, for exporters, a letter of credit is the most difficult form of settlements: receipt of payment from a letter of credit is associated with the exact observance of its conditions, correct execution and timely submission to the bank of the documents specified in the letter of credit. By monitoring compliance with the terms of the letter of credit and the submitted documents, banks protect the interests of the buyer, acting on the basis of his instructions.

The use of the letter of credit form is most favorable for the seller of goods (payee). Settlements under the letter of credit are made at the place of its location, which brings the payment closer in time to the moment of shipment of goods, contributing to the acceleration of the turnover of the seller's funds. In turn, the untimely opening of the letter of credit by the payer allows him to delay the delivery or even refuse to fulfill the concluded agreement, citing the insolvency of the counterparty. Opening a letter of credit gives him confidence that the delivered goods will be paid for.

Settlements for collection, carried out in accordance with the Unified Rules, are beneficial both for banks and for the parties to the transaction. When executing customer orders, banks do not need to open an additional account or accumulate funds in another way (for example, a letter of credit). The buyer can be sure that after paying for the settlement documents, he will receive the right to the goods, as well as shipping and title documents. The supplier will be sure that until the money is received, his goods will be at his disposal.

In international banking practice, bank transfers can be used to pay an advance under a contract if its terms contain a clause on the transfer of part of the contract value (15-30%) in advance, i.e. before the goods are shipped. The rest is paid for the actually delivered goods. Advance payment actually means hidden crediting of the exporter and is disadvantageous for the importer. In addition, the transfer of the advance creates the risk of losing money for the importer if the exporter fails to fulfill the terms of the contract and does not deliver the goods.

In order to protect the importer from the risk of non-refund of the advance payment in case of non-delivery by the exporter of the goods, there are several ways of protection in international banking practice:

1. Obtaining a bank guarantee for the return of the advance payment - in this case, a guarantee of a first-class bank is issued before the transfer of the advance payment.

2. Using a documentary or conditional translation - in this case, the exporter's bank makes the actual payment of the advance, provided that the exporter submits the transport documents within a certain period.

Providing a loan on an open account and making settlements in this form are associated for the seller with the risk of non-payment or late payment for the goods, since the buyer does not issue any promissory note to the seller upon receipt of the trade documents. And for the buyer, an open account is a profitable form of payments and obtaining loans, because there is no risk of payment for undelivered goods. In addition, interest for using a loan is usually not charged. Therefore, firms using an open account often act alternately as sellers and buyers, which is one way to ensure that the parties meet their payment obligations.

Unlike settlements on an open account, settlements in the form of an advance most often mean crediting the exporter by the importer. At the same time, on the instructions of the exporter for the amount of the advance, the exporter's bank usually issues in favor of the importer a guarantee of the return of the advance received in case of non-fulfillment of the terms of the contract and non-delivery of the goods.

A check form of settlement, like a letter of credit, provides certain guarantees to exporters.

Thus, the most preferable for the exporter are letter of credit, collection, bank and advance transfers. For the importer, the most acceptable are collection with preliminary acceptance, subsequent transfer (payment after receipt of the goods).

Advantages and limitations forms international calculations... The advantage of the letter of credit form of settlements - unlike other forms of non-cash settlements, the letter of credit guarantees payment to the supplier either at the expense of own funds the buyer, or at the expense of his bank; as well as control over the fulfillment of the terms of delivery and the terms of the letter of credit by banks.

The disadvantages of the letter of credit form of settlements are - complicated document circulation and high cost, since the buyer's funds in the amount of the letter of credit are diverted from his economic circulation for the duration of the letter of credit; the turnover is slowing down, since the supplier, prior to the notification of the opening of the letter of credit, cannot ship already finished products and incurs additional costs for its storage. In addition, with the letter of credit form of settlements, delays in the movement of documents occur due to the control of documents in banks and their transfer between banks.

The advantage of the collection form of settlements is that they are beneficial to the buyer - banks protect his rights to the goods until the payment of documents or acceptance. The documents received by the buyer for verification remain at the bank's disposal until the moment of payment (acceptance) and, in case of non-payment, are returned to the bank indicating the reasons for non-payment (non-acceptance).

However, along with the advantages, collection settlements have a number of disadvantages. In particular:

1. Between the shipment of goods, the transfer of documents to the bank and the receipt of payment, there is a large gap in time, which slows down the turnover of the exporter's funds.

2. By the time the documents arrive at the importer's bank, he may refuse to pay for them or be insolvent.

3. Delivery of goods may precede the receipt of documents in the bank and receipt of shipping documents by the importer, which increases the risk of the exporter from non-payment of goods by the importer.

Such situations can be avoided by using a telegraph collection when:

either the importer is notified by telegraphic notice of the dispatch of documents containing the main details of the collection order;

or the exporter's bank sends the documents to the foreign bank only upon receipt of a notification from him about the crediting of the funds that secure the payment.

The main advantage of settlements by checks is the guarantee of payment, the main disadvantage is the complication of document circulation, since funds are credited to the supplier (check holder) not at the moment the checks are presented to their bank, but only after they are debited from the payer's (drawer) account.

The lack of circulation of bills is associated with the ineffectiveness of the mechanism for collecting funds on bills and unresolved legal issues - the legal and regulatory framework is constantly expanding, there are no methods for banks when providing credit in the form of a bill.

In addition, the type of goods - the object of the transaction, as well as the level of supply and demand for the goods - the object of the transaction, is of great importance.

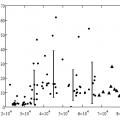

The fundamental differences between the main forms of international settlements are summarized in Table 1.

Table 1

Comparative characteristics main forms of international settlements

|

Comparison point |

Bank transfer |

Letter of credit |

Credit (including with a bill of exchange) |

Check form of settlements |

||

|

Importer's risk |

Maximum, in case of advance payment |

Minimum |

Significant |

|||

|

Exporter's risk |

In case of 100% advance payment - minimum |

Minimum |

Significant |

|||

|

Share of participation of banks |

Minimum |

Maximum degree of participation (the bank is the guarantor) |

There is a benefit for banks. |

Minimal or absent |

Minimum (The bank is not responsible to the drawer) |

|

|

Other characteristics |

The most simple form. Easy and often doable |

A very complex form of calculations, but the maximum possible. Implemented on tight deadlines |

Most balanced form. For some reason, this form is not recognized by the parties |

It largely depends on the reliability of the counterparty. Requires certain guarantees. |

Limited terms of use |

The applied forms of international settlements differ in share participation commercial banks v their holding.

The minimum participation of banks is assumed when making a bank transfer. When making settlements by bank transfers, commercial banks execute payment orders of foreign banks or pay, in accordance with the terms of correspondent agreements, the bank checks issued on them for the monetary obligations of foreign importers, and also issue payment orders and bank checks to foreign banks for the monetary obligations of Russian importers.

When performing a transfer operation, the beneficiary's bank is guided by specific instructions contained in the payment order. For example, a payment order may contain a clause on the payment of the appropriate amount to the beneficiary against providing them with the commercial or financial documents specified in the payment order or against providing them with a receipt.

When performing a transfer transaction, banks take part in settlements by transferring only after the payer submits a payment order to the bank to pay for the contract. However, banks are not responsible for the payment. Banks do not control the fact of delivery of goods or transfer of documents to the importer, as well as the execution of payment under the contract. With this form of settlement, the bank is only responsible for transferring the payment from the account of the originator to the account of the recipient at the time of the submission of the payment order.

The share of banks' participation in the collection operation is more significant. The use of payment orders (bank transfer) means that the bank assumes the obligation, on behalf of the payer, at the expense of the funds in his account, to transfer a certain amount of money to the account of the person indicated by the payer in this or another indicated bank within the time period prescribed by law or established in in accordance with it, if a shorter period is not provided for by the bank account agreement or is not determined by the customs of business used in banking practice.

The role of banks in making settlements between counterparties using letters of credit is maximum in comparison with other forms and consists in mediation, they only control the compliance of the submitted documents with the list of documents specified in the letter of credit. Banks are not responsible for the safety and transportation of goods, for the accuracy of registration, for the legality or reliability of the documents submitted to them. The bank - the issuer of the letter of credit cannot refuse to make the payment if the submitted documents comply with the terms of the letter of credit. Thus, banks are only responsible for financial aspect transactions without assuming any obligations regarding the goods listed in the sales contract.

A check is associated with the availability of funds in the account of the drawer and is used as a means of disposing of this account, a private obligation as a means of payment. The check holder's debt can be repaid only if the required amount is available on the check issuer's account. The bank is not liable to the drawer for the payment of a check issued to it. But the bank may have an agreement with its client that allows him to issue checks to his account in excess of a certain amount of the credit balance on the current account - overdraft.

Since international settlements are closely related to credit relations, the presence or absence of credit agreements (both at the interstate level and at the level of counterparties) also affects the choice of the form of settlement.

Since checks are not a lending instrument, but are a means of managing a current account, their validity periods are limited. According to the 1931 Geneva Convention on the Check, which regulates check circulation in international settlements, the period of its validity within one country is 8 days, and for payment in other countries - 20 - 70 days, including the time for payment and transfer of money to the exporter.

So, the choice of a specific form of settlement, in which payments will be made under a foreign trade contract, is negotiated in a foreign trade transaction and is determined by a number of factors - the specifics of the application, the degree of risk of exporters and importers, a list of advantages and disadvantages of the form of international settlements, the shares of participation of commercial banks in settlements.

Conclusion

One of the most difficult problems in commercial practice companies is the question of ensuring the break-even of foreign trade, since the latter, from a calculation and financial point of view, is accompanied by an increased risk. The fulfillment of financial obligations by foreign counterparties, which are part of the terms of a foreign trade transaction, is largely determined by the form of selected settlements and the procedure for their execution, which are subject to international practice, and also depend on the nature of monetary and financial restrictions on domestic market country.

The form of settlement represents the methods of registration, transfer and payment of shipping and payment documents established in international commercial and banking practice.

Taking into account the mutual interests of participants in foreign economic transactions, settlements are carried out in various forms - in the form of advance payments, by way of collection or acceptance of a bill of exchange, checks, using a letter of credit, etc.

The choice of a specific form of settlement, in which payments will be made under a foreign trade contract, is negotiated in a foreign trade transaction and is determined by a number of factors - the specifics of the application, the degree of risk of exporters and importers, a list of advantages and disadvantages of the form of international settlements, the share of participation of commercial banks in settlements.

The safest, often used, but organizationally complex form of settlements between the seller and the buyer is a letter of credit.

The simplest, easiest and most frequently carried out form is a bank transfer.

The most balanced form - collection, however, is not popular in Russia.

List of sources used

1. the federal law Of the Russian Federation of 08.12.2003, No. 164-FZ "On the foundations of state regulation of foreign trade" (as amended on 06.12.2011 No. 409-FZ) // SPS "Consultant" [Electronic resource]. - Access mode: World Wide Web. URL: http: // base. consultant.ru/cons/cgi/online. cgi? req = doc; base = law; n = 123030

2. Uniform rules and customs for documentary credits

3. (Publication of the International Chamber of Commerce No. 600 dated 1.07.2007) // ATP "Consultant" [Electronic resource]. - Access mode: World Wide Web. URL: http: // base. consultant.ru/ cons / cgi / online. cgi? req = doc; base = LAW; n = 132534

Similar documents

The essence and necessity of using international settlements. Features of the application of various forms of international payments. Problems and prospects for the development of international settlements in the Republic of Belarus. Settlements for non-trading operations for services.

term paper, added 04/12/2012

The relationship of foreign economic turnover and the movement of funds between countries, methods of international settlements. Disclosure of the advantages and disadvantages of the main forms of international settlements. Application of collection form of settlements and letters of credit.

term paper added 11/14/2013

The concept of international settlements and their essence. State regulation of international settlements. Monetary and financial conditions of the foreign trade contract. Basic terms of delivery. The procedure for reflecting international settlements in accounting accounts.

term paper, added 01/27/2009

International settlement relations, forms of international settlements and their classification. Use of national currencies, international accounting units and gold. Letter of credit form of payments. The main features of international settlements and payments.

test, added 01/15/2016

Types of balances of international settlements. Consideration of the concept, history of the emergence and development of the balance of payments. Description of methods of state regulation of international settlements - deflationary and financial policy, currency restrictions.

abstract, added 05/20/2012

Concept, essence and government regulation international settlements. Application procedure, advantages and disadvantages modern forms calculations. The concept of export-import operations, the process and form of concluding an export contract, types of offer.

test, added 04/09/2009

Forms of international settlements used in world practice. The procedure for the use, regulation of forms of international settlements in the Republic of Belarus. Organization of settlements in the foreign economic activity of LLC "Massive", directions of its improvement.

term paper, added 08/28/2010

State of the art foreign economic sector of Russia. Features of foreign trade contracts. Principles of international settlements. Analysis of international banking services banks of the Russian Federation. Features of international trade settlements of an economic entity.

thesis, added 12/12/2009

term paper added 01/13/2003

Essence, concept, forms and types of international settlements. Their features and order of implementation. general characteristics the foreign exchange market of the Russian Federation and the dynamics of world prices. Features of cashless payments in the Savings Bank of the Russian Federation.

Savostyanov V.A. Head of the department for work with clients of CB "Russian General Bank",

Zubenko V.A. Ph.D., Associate Professor, Institute of World Economy and Informatization

INTRODUCTION

V modern conditions money is an essential attribute of economic life. Therefore, all transactions related to the supply of material values and the provision of services are completed in cash. Settlements are a system for organizing and regulating payments for monetary claims and obligations. The main purpose of settlements is to service money turnover (payment turnover). Calculations can take both cash and non-cash form. Cash and non-cash forms of cash payments business entities can function only in organic unity. Organization of cash settlements using non-cash money is much preferable to cash payments, since in the first case, significant savings on distribution costs are achieved. The widespread use of non-cash payments is facilitated by an extensive network of banks, as well as the interest of the state in their development, both for the above reason, and for the purpose of studying and regulating macroeconomic processes.

The economic base of non-cash payments is material production. As a result, the predominant part of the payment turnover (approximately three quarters) falls on settlements for commodity transactions, i.e. for payments for goods shipped, work performed, services rendered.

The rest of the payment turnover (approximately one quarter) is settlements for non-commodity transactions, i.e. settlements of enterprises and organizations with the budget, state and social insurance bodies, credit institutions, governing bodies, courts, etc.

Monetary funds, both own and borrowed, in accordance with the legislation are subject to mandatory storage in banks, with the exception of proceeds, the expenditure of which is permitted in accordance with the established procedure by the bank serving the economic entity.

In my opinion, the most important aspects analysis of monetary forms of circulation are: firstly, the general foundations of the organization of international non-cash settlements, and secondly, the features of interbank settlements and, of course, the forms of settlements used by participants in foreign trade.

1. CONCEPT AND TYPES OF FOREIGN TRADE TRANSACTIONS

Russian law does not contain the concept of a foreign economic transaction. Russian doctrine and practice refers to foreign economic transactions that have two essential features: firstly, the transaction involves persons (subjects) of different nationalities, and secondly, the circle of relations in the sphere of which such transactions are concluded (export-import operations goods, services, etc.). Foreign economic transactions include a work contract, an exchange agreement, contracts for the provision of various services for the provision of technical assistance in the construction of industrial facilities, as well as an agreement for foreign trade purchase and sale of goods.

There are different types of sales contracts.

A one-time supply contract is a one-time agreement that provides for the delivery of an agreed quantity of goods by a specific date, time, period of time. The delivery of goods is made one or more times within a specified period. Upon fulfillment of the obligations assumed, the legal relationship between the parties and the contract itself is terminated.

One-time contracts can be with short delivery times and long delivery times.

A contract with periodic delivery provides for the regular (periodic) supply of a certain quantity, batches of goods over a period established in the terms of the contract, which can be short-term (usually one year) and long-term (5-10 years, and sometimes more).

Contracts for the supply of complete equipment provide for the existence of links between the exporter and the buyer-importer of the equipment, as well as specialized forms involved in the completion of such a delivery. At the same time, the general supplier organizes and bears responsibility for the complete set and timeliness of delivery, as well as for the quality.

Depending on the form of payment for the goods, a distinction is made between contracts with payment in cash and with payment in commodity form in whole or in part. Contracts with payment in cash provide for settlements in a certain currency agreed by the parties using the payment methods specified in the contract (cash payment, payment with an advance and on credit) and payment forms (collection, letter of credit, check, bill).

Contracts with payment in a mixed form have become widespread in modern conditions, for example, during construction on a turnkey basis of targeted lending to an enterprise, payment of costs occurs partly in cash and partly in commodity form.

In our country, barter transactions are widespread - commodity exchange and compensation agreements, which provide for a simple exchange of agreed quantities of one product for another. These agreements either establish the number of mutually supplied goods, or stipulate the amount at which the parties undertake to deliver the goods.

A simple compensation agreement, like a commodity exchange agreement, provides for the mutual supply of goods at an equal value. However, unlike a commodity exchange, a compensation transaction provides for the parties to agree on the prices of mutually supplied goods. In such a transaction, usually not two goods appear, but a significant number of goods offered for exchange.

2. LEGAL REGULATION OF FOREIGN ECONOMIC TRANSACTIONS

In the legal regulation of foreign economic transactions, international treaties of a regional and universal nature play an important role. Of particular importance when concluding foreign economic contracts is the 1980 UN Convention on Contracts for the International Sale of Goods (Vienna Convention), to which (as the successor to the USSR) the Russian Federation, CH, is a party, containing general conditions and procedure for making payments. The USSR joined it on May 23, 1990, therefore its provisions are binding on Russia by virtue of succession. Vienna Convention 1980. Entered into force on the territory of Russia on September 1, 1994.

The Convention provides for the obligation of the buyer to pay the price for the goods, the place and term of payment, the consequences of non-payment for the goods, including the accrual of interest for late payment, compensation for losses, etc. are established.

"The procedure for payments under foreign economic contracts is provided for by other international agreements, in particular General conditions deliveries of goods between organizations of the CMEA member countries (OUP CMEA 1968/1998), General conditions for the supply of goods from the USSR to the People's Republic of China and from the People's Republic of China to the USSR, General conditions for the supply of goods between foreign trade organizations of the USSR and foreign trade organizations Democratic People's Republic of Korea ". It should be borne in mind that in accordance with the current legislation, international treaties (conventions) in which the Russian Federation participates are considered as part of the national legal system, which has a priority and binding character. This follows from paragraph 4 of Art. 15 of the Constitution of the Russian Federation, which enshrined the rule that: “generally recognized principles and norms of international law and international treaties of the Russian Federation are part of the legal system. If an international treaty establishes rules other than those provided by law, then the rules of the international treaty are applied. "

There are also a number of international agreements of a universal level on the regulation of foreign economic transactions. These are, first of all, the Hague Conventions of 1964 "On the Uniform Law on the International Sale of Goods" and "On the Uniform Law on the Procedure for Concluding Contracts for the International Sale of Goods". Due to the limited number of countries that have signed these conventions, they are not widely used. The USSR (and, therefore, Russia) is not a party to these conventions. This convention is of a universal and compromise nature, since it takes into account the principles and institutions of various legal systems, and also takes into account the interests of developing countries in establishing a new international economic order. The 1964 Hague Conventions are essentially incorporated into the 1980 Vienna Convention.

States parties to the Hague Conventions of 1964 must declare their denunciation in the event of accession to the Vienna Convention of 1980 (Art. 99, Ch. 3) or its ratification. In connection with the special procedure for signing foreign economic transactions provided for in Russian legislation, provided for in the Resolution of the Council of Ministers of the USSR dated 02.14.1978, the Vienna Convention of 1980. It is valid on the territory of Russia with the clause on compliance with the written form of contracts for the international sale of goods, if one of the parties is a Russian enterprise.

The terms on payments under foreign trade contracts are also included in the document “Principles of International Commercial Contracts” adopted in 1994 by the International Institute for the Unification of Private Law (UNIDROIT), which can also be used in the conclusion of contracts.

“International customs play an important role in the conclusion and execution of foreign economic transactions, and especially international sale and purchase agreements. In order to avoid contradictions between trading partners in understanding trade customs, the International Chamber of Commerce developed and published collections of their interpretations - "Incoterms" - in 1953. Over time, "Incoterms" were reprinted several times, making additions and changes. From a legal point of view, "Incoterms" is a set of rules that have an optional character, which follows from the indication of paragraph 22 of the Introduction to the 1990 edition that merchants wishing to use these rules must provide that their contracts will be governed by the provisions of "Incoterms "1990" ...

The application of basic conditions simplifies the drafting and negotiation of contracts, helps counterparties to find equitable ways of resolving disagreements that arise.

The main commercial document is the commercial invoice, or invoice. A commercial invoice is issued to the buyer and contains an indication of the amount to be paid. The commercial invoice contains the full and exact name of the goods; in other documents, the description of the goods can be given in general terms.

The transport document is the basis for issuing a commercial invoice. Transport documents include: bills of lading (sea and river), giving their holders the right of ownership of the goods; waybills (railway, road and air waybills); acceptance certificates, as well as postal receipts, safekeeping receipts and warehouse receipts.

Insurance policies or insurance certificates indicate the existence of a cargo insurance contract.

Other commercial documents include various types of certificates (origin, quality, weight, dimensions, etc.).

The terms of the contract must indicate the name of the documents to be submitted and by whom they must be issued, and if the submission of specific documents is required, their content.

3. FORMS

INTERNATIONAL SETTLEMENTS

In the practice of international trade, the form of payment for the delivered products, work or services performed is of great importance. Taking into account the mutual interests of participants in foreign economic transactions, settlements are carried out in various forms - in the form of advance payments, by way of collection or acceptance of a bill of exchange, checks, with a letter of credit, etc.

"When making non-cash settlements, settlements are allowed by payment orders, letters of credit, checks, cash collection settlements, as well as settlements in other forms provided for by law, banking rules established in accordance with it and business customs applied in banking practice" (Clause 1 of Art. . 862 of the Civil Code of the Russian Federation).

The form of settlement represents the methods of registration, transfer and payment of shipping and payment documents established in international commercial and banking practice. These forms of international settlements are used for payments, both in cash and on credit. At the same time, bank transfers are used in payments for cash, documentary letters of credit - in payments for cash and when providing a short-term commercial loan, collection form of payments - for payments in cash, as well as for payments using a commercial loan.

The choice of a specific form of settlement in which payments will be made under a foreign trade contract is determined by agreement of the parties - partners in a foreign trade transaction.

The procedure for making settlements for exported and imported goods (services) is regulated by the legislation of the country, and is also subject to international rules for documenting and paying for payment documents.

The applied forms of international settlements differ in the share of participation of commercial banks in their implementation. The minimum participation of banks is assumed when making a bank transfer, i.e. execution of the client's payment order. A more significant share of banks' participation in the collection operation is control over the transfer, forwarding of shipping documents and their issuance to the payer in accordance with the terms of the principal. The maximum share of banks' participation is in settlements by letters of credit, which is expressed in the provision of a payment obligation to the recipient (beneficiary), which is realized subject to the conditions contained in the letter of credit.

3.1. Bank transfer Bank transfer concept

"A bank transfer is a simple order of the bank to its correspondent bank to pay a certain amount of money at the request and at the expense of the originator to the foreign recipient (beneficiary), indicating the method of reimbursement of the paid amount to the paying bank."

Bank transfer is carried out by bank transfer from one bank to another. Sometimes transfers are made using bank checks or other payment documents. Commercial or shipping documents are sent in this form of payment from the exporter to the importer directly, i.e. bypassing the bank.

When making settlements by bank transfers, commercial banks execute payment orders of foreign banks or pay, in accordance with the terms of correspondent agreements, the bank checks issued on them for the monetary obligations of foreign importers, and also issue payment orders and bank checks to foreign banks for the monetary obligations of Russian importers.

When performing a transfer operation, the beneficiary's bank is guided by specific instructions contained in the payment order. For example, a payment order may contain a clause on the payment of the appropriate amount to the beneficiary against providing them with the commercial or financial documents specified in the payment order or against providing them with a receipt.

Rice. 1. Scheme of settlements by bank transfers

When performing a transfer transaction, banks take part in settlements by transferring only after the payer submits a payment order to the bank to pay for the contract. However, banks are not responsible for the payment. Banks do not control the fact of delivery of goods or transfer of documents to the importer, as well as the execution of payment under the contract. With this form of settlement, the bank is only responsible for transferring the payment from the account of the originator to the account of the recipient at the time of the submission of the payment order.

After the conclusion of the contract (1) between the importer and the exporter, the importer sends an application for transfer to the bank (2). The delivery of goods (3) may precede or follow payment, which is determined by the terms of the contract and the currency laws of the countries.

The importer's bank, having accepted the payment order from the importer, sends on its own behalf the payment order (4) to the corresponding exporter's bank. Having received the payment order, the bank verifies its authenticity and makes an operation to credit money (5) to the exporter's account.

In international banking practice, bank transfers can be used to pay an advance under a contract if its terms contain a clause on the transfer of part of the contract value (15-30%) in advance, i.e. before the goods are shipped. The rest is paid for the actually delivered goods. The advance payment actually means hidden crediting of the exporter and is disadvantageous to the importer. In addition, the transfer of the advance creates the risk of losing money for the importer if the exporter fails to fulfill the terms of the contract and does not deliver the goods.

In order to protect the importer from the risk of non-refund of the advance payment in case of non-delivery by the exporter of the goods, there are several ways of protection in international banking practice:

obtaining a bank guarantee for the return of the advance; in this case, prior to the transfer of the advance payment, a first-class bank guarantee is issued;

use of documentary or conditional translation; in this case, the exporter's bank makes the actual payment of the advance to his account, subject to the provision of transport documents to them within a certain period.

Legal features of transactions using bank transfers

Settlements by payment orders (bank transfer) is the most frequently used form of settlement in property turnover. In some legal relationships, the use of this form of payment has a priority. For example, in relations for the supply of goods, the buyer pays for the supplied goods in compliance with the procedure and form of settlements stipulated by the supply contract. If by agreement of the parties the procedure and forms of settlements are not determined, then settlements are carried out by payment orders (see article 516 of the Civil Code of the Russian Federation).

The use of this form of settlement means that the bank assumes the obligation, on behalf of the payer, at the expense of the funds in his account, to transfer a certain amount of money to the account of the person indicated by the payer in this or another specified bank within the period provided for by law or established in accordance with it. if a shorter period is not provided for by the bank account agreement or is not determined by the customs of business practice used in banking practice (clause 1 of article 863 of the Civil Code of the Russian Federation).

3.2.Incasso

Collection concept

One of the most balanced forms of settlements, both for the buyer and the supplier, will be collection settlements. Collection is an order of the exporter to his bank to receive from the importer (directly or through another bank) a certain amount or confirmation (acceptance) that this amount will be paid in due time. Collection is used in settlements both under the terms of payment in cash and with the use of a commercial loan.

Often, problems in choosing the forms of settlements between Russian entrepreneurs and their foreign partners arise from elementary ignorance of the regulatory framework.

For collection operations, banks and their clients are governed by the Uniform Rules for Collection (Publication of the International Chamber of Commerce No. 522, entered into force in a new edition on January 1, 1996). Unified collection rules are the main international normative document governing this form of payment.

The unified rules determine the types of collection, the procedure for submitting documents for payment and making a payment, acceptance, the procedure for notification of payment, acceptance or non-payment (non-acceptance), determine the obligations and responsibilities of the parties, give a uniform interpretation of various terms and resolve other issues.

Rice. 2. Scheme of payments for collection

According to the Unified Rules, collection is an operation carried out by banks on the basis of instructions received with documents in order to:

- receiving acceptance and / or payment;

- issuance of commercial documents against acceptance and / or payment;

- issuance of documents on other terms.

Depending on the types of documents with which the collection operation is performed, there are two types of collection:

- net collection, i.e. collection of financial documents, which include checks, bills of exchange, payment receipts and other documents used to receive payment in cash;

- documentary collection, i.e. collection of commercial documents, which may or may not be accompanied by financial documents.

The participants in the collection operation are:

- principal - a client who entrusts a collection operation to his bank;

- remitting bank - a bank to which the principal entrusts a collection operation;

- collecting bank - any bank, which is not a remitting bank, participating in an operation to execute a collection order;

- presenting bank - a bank directly receiving payment or acceptance, submitting documents to the payer;

- payer - a person to whom documents must be submitted in accordance with a collection order.

Settlements in the form of collection are structured as follows (see diagram). After the conclusion of the contract (1), in which the parties agree, through which banks the settlements will be made, the exporter ships the goods (2) in accordance with the terms of the concluded contract. Having received transport documents from the transport organization (3), the exporter prepares a set of documents, which includes commercial and, possibly, financial documents, and submits it to his bank (remitting bank) with a collection order (4).

Having received the documents from the principal, the remitting bank checks them according to their external features, which are indicated in the collection order, and then acts in accordance with the instructions of the principal contained in this order and the Unified Rules.

The remitting bank sends the documents to the collecting bank (5), which is, as a rule, the bank of the importing country.

Legal features of the commission

transactions with collection